Even though Customer Success as an industry is hitting its stride and more CS leaders are earning a seat at the table, too many businesses still struggle to understand CS’s direct impact on their bottom line. Customer Success charters are expanding to cover more revenue-related activities, but CS leaders can do more to validate their influence on their company’s overall revenue growth. To illuminate your team’s effect on strategic expansion, we suggest wielding a mighty metric that packs a real punch – one that even Wall Street uses as a shorthand way to evaluate the health and vitality of a company. We’re talking big picture, financial perspective data and analytics, baby!

Now, there’s much debate about how to really measure Customer Success performance. Renewal rates? Customer Health Scores? Churn? NPS? The list goes on and on. These are all important metrics to keep in mind as you choose the best KPIs to showcase the results of your CS team’s efforts. But there’s one KPI in particular that you need to pay attention to these days, and that’s Net Revenue Retention (NRR).

Why are we crowning NRR as the new king of CS metrics? It boils down to understanding what the C-suite cares about and how Customer Success aligns with greater company-wide targets and goals. Leadership wants to see Customer Success as a revenue driver rather than a cost center. As a metric that illustrates your team’s ability to retain and grow revenue from your existing customer base, NRR can help achieve this goal.

What is Net Revenue Retention?

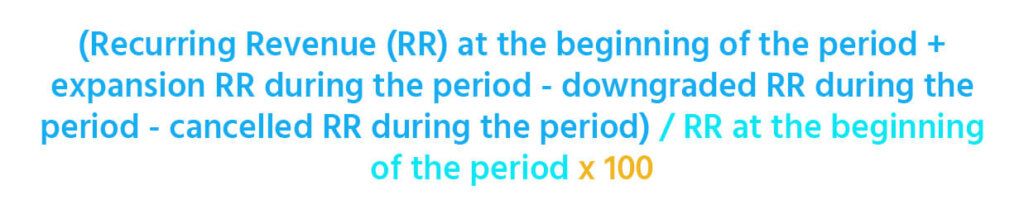

Net Revenue Retention is the percentage of recurring revenue retained from existing customers over a given period (usually monthly or annually). It considers income from upgrades, cross-sales, downgrades, and cancellations.

For example, let’s say your customer base of recurring revenue is worth $1 million. Over a 12-month period, that number grows to $1.2 million. However, 10% of your customers canceled their contracts with you during that same period. Your NRR would be 110%.

NRR calculates precisely how much you’ve grown your current customer base. It’s a deceptively simple metric that demonstrates a fundamental connection between Customer Success and profitability. A strong NRR means that the business does more than sign up new customers. It means your organization is capable of nurturing customer relationships and fostering valuable growth.

A quick note: From a Customer Success perspective, we’re treating NRR the same as Net Dollar Retention (NDR). Most of the CS world uses the term NRR, and they are essentially interchangeable within a CS context. From a financial or accounting perspective, they do technically differ slightly, but not in a way that affects how CS will use this metric.

The only CS metric your board of directors cares about

At the top, two questions matter more than any other: Is your business generating new sales? And is your business retaining and growing your current customer base? Topline revenue growth and NRR. Net Revenue Retention is the ultimate KPI here because it is the metric that drives the valuation of a company. Your CFO and CEO care about NRR because it is how the business world appraises your company’s health. This is the CS metric your board of directors asks your C-suite about the most.

If you’re a CS leader struggling to get a seat at the table, it could be because you aren’t making a strong enough connection between your team’s activities and Net Revenue Retention.

Customer Success organizations are rapidly evolving to take on revenue-generating activities like renewals, expansions, and cross-sell/upsell opportunities. The 2021 Customer Success Leadership Study revealed that 55% of CS groups own renewals, and 48% own customer expansion. 76% of CS organizations have a charter to renew subscriptions, regardless of who owns that process within a company.

Businesses with more mature Customer Success departments know that it makes sense to tie CS activities to growth targets. They see CS’s impact and are more willing to hand over the reins to these arenas. In the future, we expect the connection between Customer Success and revenue generation will be seen as the default.

But, if you’re struggling to develop a clear line of sight between NRR and CS because you don’t own revenue, there are other ways to illustrate your relationship to it. For example, early-stage CS teams might need to remain laser-focused on onboarding new customers. That’s ok! You’re still influencing the revenue side of the customer journey. Improving onboarding systems and processes reverberates down the line and results in better renewal and expansion numbers. Find the metrics that demonstrate these links and connect them to your business’s NRR. The ability to correlate leading and lagging indicators in this way will be instrumental to making the case – even if you think you’re not impacting NRR, you are!