October 2016 | Signature Research

No More Waiting Room: The Future of the Healthcare Customer Experience

What does it mean to be a healthcare consumer today? And what will the healthcare customer experience look like five years from now?

Get the full reportNo More Waiting Room: The Future of the Healthcare Customer Experience

What does it mean to be a healthcare consumer today? And what will the healthcare customer experience look like five years from now? Some clues can be found in the story of Nike’s brand evolution.

For decades, a Nike customer’s experience ended at the register. But in the early 2000s, Nike’s executives strategized engaging in the customer experience well beyond the point of sale. Beginning with the launch of Nike+ in 2006, Nike established a digital brand community – one built around continuous customer engagement. By engaging customers beyond the checkout counter, Nike redefined how customers interacted with and perceived the brand. Since 2006, Nike’s digital community has expanded beyond fitness trackers to include apps and online channels. Today, Nike counts millions of members among its brand community – customers whose loyalty in large part stems from continuous engagement.

Are healthcare organizations poised to follow a similar trajectory? Today’s healthcare consumers already expect more than basic coverage and annual checkups from their insurers and providers. With the widespread emergence of technology, including wearables and connected devices, customers increasingly interact with their healthcare providers and insurers via a multiplicity of channels. This push for mobility and direct real-time communication is evolving the way healthcare services are delivered.

The age of the traditional doctor’s office is coming to an end. Doctors can now monitor heart failure patients remotely via implantable monitoring devices. Medical professionals with Doctors Without Borders can provide consults to patients across the world by using technology. More and more consumers can get in touch with their doctors and insurance providers via online portals, mobile apps, and other connected devices. Moreover, insurance companies are incentivizing digital engagement by offering rewards-based programs tied to sharing health and fitness data.

Today’s healthcare consumers crave connectedness and want a much more frequent feedback loop. But are healthcare providers and insurers prepared to meet this need?

The state of patient communication

To call the 2013 rollout of the Affordable Care Act’s HealthCare.gov website problematic would be an understatement. The site was so poorly programmed and prone to crashing that only six people were able to successfully sign up for health insurance on the day of its launch. The disastrous launch was not only a frustrating experience for customers, it threatened to undermine the validity and viability of the Affordable Care Act.

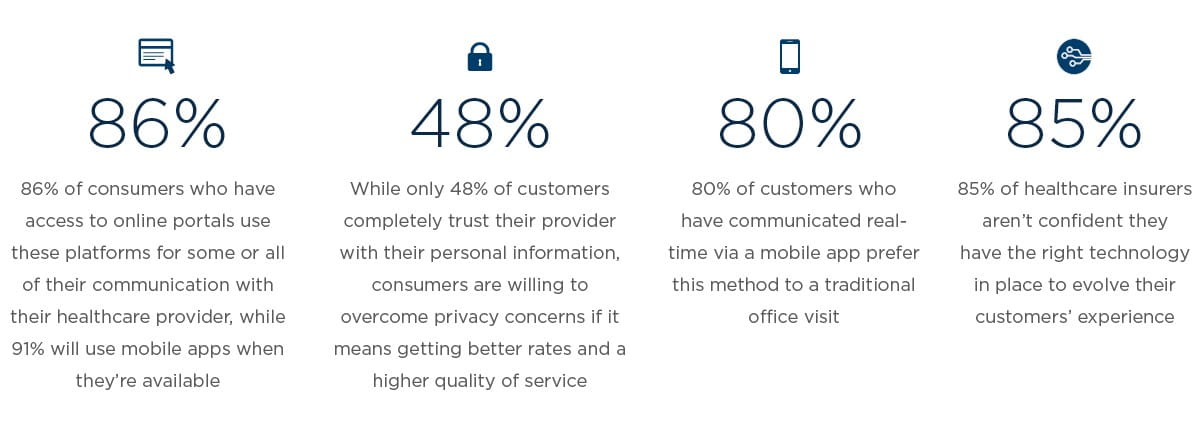

Currently, 86 percent of consumers use their provider’s online portal, while two-thirds of patients whose provider doesn’t offer a portal say they want one. The numbers for mobile apps are even higher, with 91 percent of healthcare customers taking advantage of them when offered.

In an age when many providers struggle with customer satisfaction ratings, there’s a clear link between consumer satisfaction and the availability of digital communication channels. According to consumer respondents, providers that offer an online portal earn a Net Promoter Score⁴ of 13, compared to a -28 NPS for those who do not. Similarly, providers that offer a mobile app earn a 28 NPS compared to -28 among those without an app.

This preference for providers that offer mobile apps reflects a consumer base that increasingly desires real-time communication from anywhere, and any device. Over the past two years, nearly one-third (31%) of consumers have used a healthcare mobile app to communicate with their provider in real-time about a specific condition. Eighty percent of this group prefers mobile to a traditional office visit, underscoring the notion that, for many patients, the definition of a doctor’s appointment is evolving.

As West Monroe's Senior Director of Healthcare Will Hinde notes, “Healthcare providers are realizing the impact of digital communication channels and are beginning to adapt. We’re starting to see more providers incorporate the digital experience with their office visit, by shifting to more online scheduling of appointments, paperless office interactions, following up via email, portals, and mobile apps, and taking steps towards greater cost and quality transparency.”

How age and income shape healthcare communication preferences

While high-tech channels are upending the notion of a traditional wellness visit, preferences for these emerging platforms depends on age and income level. Not surprisingly, Millennials – those between the ages of 18 and 35 – are leading the charge for digital-based provider communications.

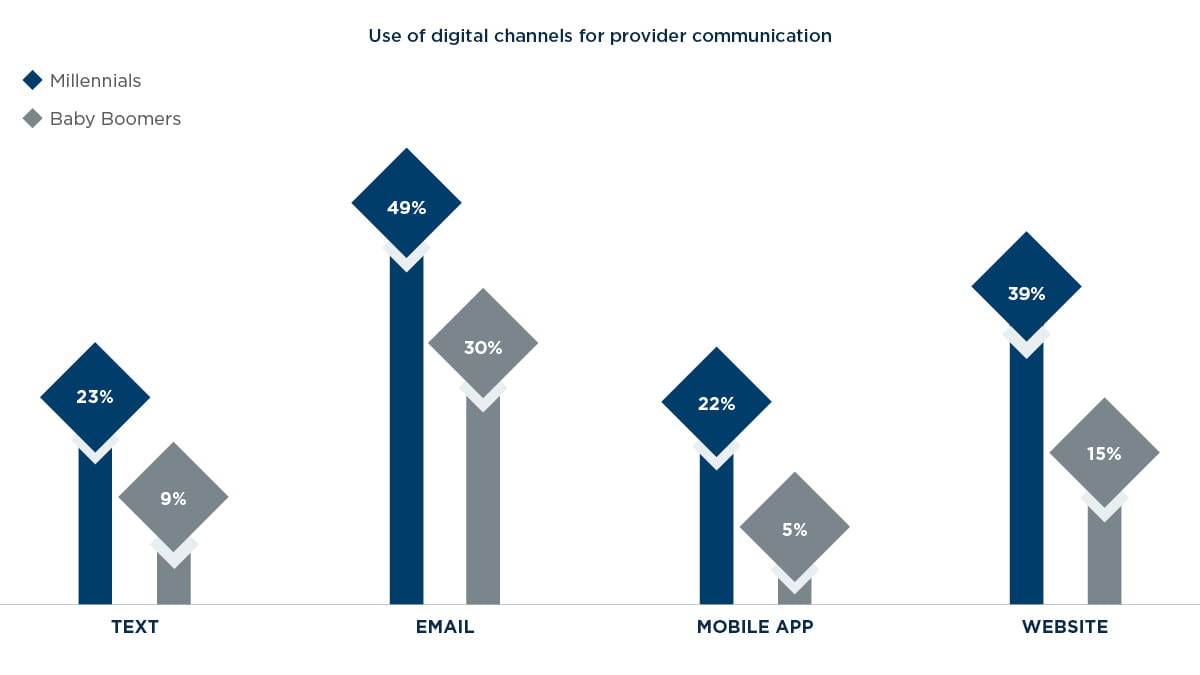

Across the board, Millennials are much more likely to use digital channels to communicate with their provider than their Baby Boomer (52-70 years old) counterparts. The contrast is particularly striking for mobile apps, which Millennials are more than four times as likely to use for provider interactions. With Millennials now the largest living generation in the U.S., healthcare providers must keep this age group’s mobile preferences top-of-mind when evolving patient communication solutions. Although there are lessons learned in catering to Millennials, Hinde advises, “Healthcare organizations should consider all generations and preferences when creating or implementing new customer-facing technologies to achieve the maximum benefit from their investment.” As insurers increasingly adopt telehealth and homecare solutions, they need to strike a balance between accommodating Millennials and applying these tools to their more senior customers.

One reason for the mobile app discrepancy between Millennials and Baby Boomers is a matter of awareness: 60 percent of Baby Boomers don’t know whether their provider offers a mobile app. Rectifying this gap could have financial implications for providers that currently service elderly patients in-person, particularly in situations where mobile solutions could offer a viable and cost-saving alternative.

The preference for mobile healthcare communication also positively correlates with consumers’ income level. Among those whose annual salary is more than $75,000, 92 percent prefer mobile “visits” to in-office appointments. By contrast, only 60 percent of consumers with salaries below $50,000 prefer to engage with their provider via mobile. Part of lower- salaried workers’ preference for in-office over mobile could have to do with a lack of exposure to these platforms: Only 21 percent of consumers making under $50,000 said their provider offers a mobile app compared to 55 percent of those making more than $75,000.

Surmounting privacy concerns with better rewards

Given the volume, scale, and visibility of healthcare-based cyberattacks, it’s no surprise less than half of consumers (48%) completely trust their provider with their personal information. This lack of trust poses a significant business obstacle for the roughly 70 percent of healthcare insurers currently offering rewards programs built around consumers sharing data collected from their health tracking devices and apps – which can help insurers provide more individualized care. Faced with a customer base that’s reticent to share personal health information, these insurers can find their rewards programs stagnating, with customer retention, loyalty, and actionable data collection suffering as a result.

Beyond winning back customers’ faith in the security of their IT systems, there’s another key step insurers can take to allay consumer privacy concerns: Provide better rewards.

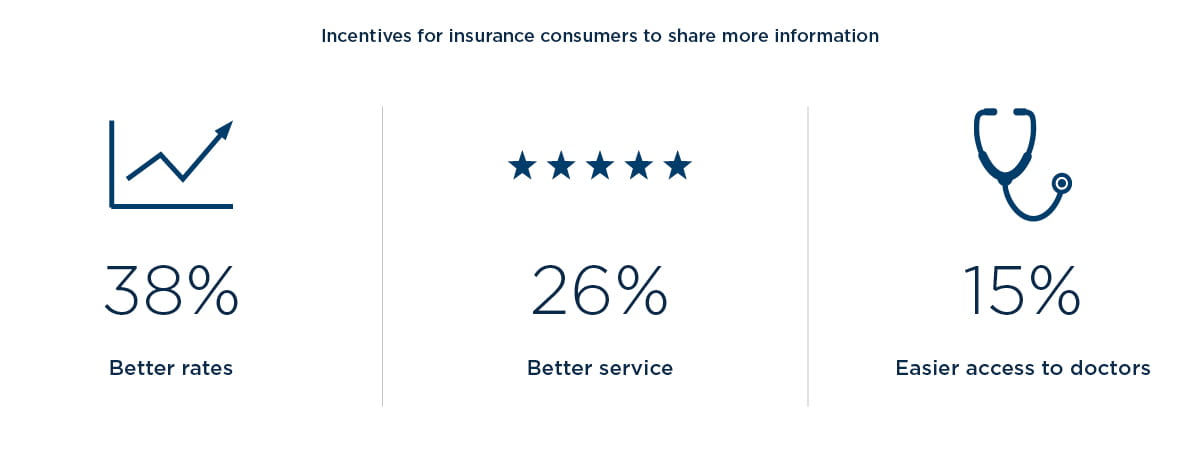

Right now, the two most common incentives healthcare insurers offer are predetermined awards (such as gift cards) and redeemable points. However, these are not the rewards consumers want. Instead, consumers want perks that are directly tied to their personal care outcomes, such as better rates, better service, and easier access to doctors.

West Monroe's Senior Director of Customer Experience Kyle Hutchins refers to this discrepancy as “white chip versus blue chip moments.” When thinking about improving customer experiences, there are white chip moments – in poker, white chips have the least value and are almost disposable, while blue chips have a much higher value. “Well-intentioned companies and employees can spend a lot of time and resources on white chip moments, while failing to do things that really matter for customers,” Hutchins explains. “One healthcare organization recently spent $100,000 on candy for the lobbies; meanwhile, things like scheduling and billing were far more important problems that drove customer dissatisfaction. We see hotels offering complimentary cookies as ‘rewards’ to drive customer loyalty, but this tactic doesn’t drive new or repeat business.

Instead, their customers want premium incentives such as room upgrades, cheaper prices, or complimentary nights.” In the same way, healthcare consumers don’t value gift cards; they want better, personalized, more convenient, and more affordable service.

In many instances, insurance customers will overcome privacy concerns and share their behavioral and health data if it means receiving a higher quality experience – a trend Hutchins points out mirrors other industries. “We’ve already seen our clients in the retail and banking industries get access to more

customer data after providing them with premium rewards and incentives,” Hutchins notes. But healthcare insurers aren’t delivering those incentives. Currently, only eight percent offer discounted rates in exchange for participation, while none offer direct discounts on products or services.

Healthcare insurers’ technology gap

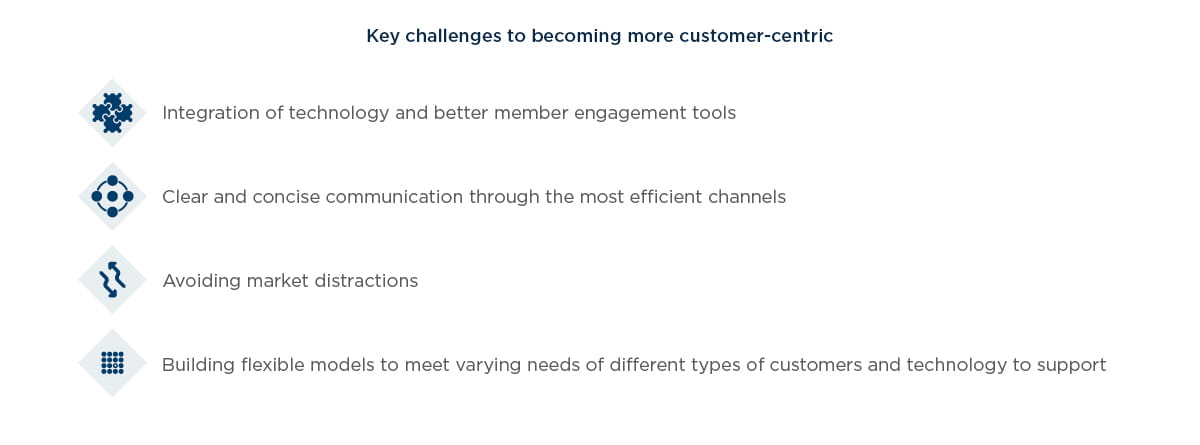

Insurance companies aren’t fully prepared to elevate their customers’ experience – and the solution calls for more than better rewards program incentives. Conversations with healthcare insurance executives revealed that although 77 percent are confident they have the right talent to provide a future-focused customer experience, they’re less assured when it comes to processes and technology.

Technology in particular is a weak point, with 85 percent of executives not sure their company has the technology in place to advance their customers’ experience. Additionally, 54 percent aren’t confident they have the processes to evolve that experience.

Prioritizing personalized communications

Despite uncertainty in the ability of their existing infrastructure to keep up with customers’ evolving needs, healthcare insurers overwhelmingly report their members do receive personalized communications.

Now that personalized communication is a normative practice – with 92 percent of healthcare insurers sending tailored messages to customers – the question turns to what personalized channels these organizations communicate through. While all surveyed insurers use mail and the vast majority use email and phone – 92 percent and 83 percent, respectively – only one-third rely on web portals to connect with customers, and one-quarter use text.

The fact that most insurers currently limit personalized communication to mail, email, and phone is problematic considering the rising generation of healthcare consumers prefers online portals, mobile channels, and messaging platforms. And although 69 percent of insurers intend to rectify that issue by incorporating instant messaging as a customer interaction channel within the next two years, this may be too little too late. Given the accelerating speed of technology innovation, by the time insurers add platforms like social media and instant messaging, they’ll be behind on other technologies.

Going beyond the doctor’s office

For an emerging generation of young, tech-native consumers, the healthcare experience means more than an annual checkup. It means a connected experience driven by real-time, digital communication across multiple channels.

Today, healthcare customer satisfaction is closely tied not only to their doctor’s bedside manner, but to the availability of online portals and mobile apps and other modes of convenience. Meanwhile, the rapid evolution of solutions like smart devices and wearables will only expand the channels through which consumers expect to connect with their providers.

Just as Nike evolved its customer experience beyond the point of sale, it’s time for healthcare providers and insurers to extend theirs beyond the doctor’s office. Tomorrow’s consumers want continuous engagement and personalized service to help them manage their health. In the same way that Nike cemented customer loyalty through engaging customers in the contexts they use the products, providers and insurers may soon find themselves in a digital arms race – competing for customers based on the best online portals, mobile apps, other connected devices, or personalized incentives offered.

For healthcare organizations that aren’t confident in the abilities and potential of their existing technology, adapting to this paradigm shift will be easier said than done. But by approaching key challenges with decisive measures, providers and insurers can move in the right direction. Here are three strategic steps they can take to stay ahead of the curve and best meet the needs of tomorrow’s consumers:

Future-proof the communication model

A personalized communication model built around phone, mail, and email is not a future-focused approach. To retain and attract digitally inclined customers, providers need to extend personalization to online portals, mobile apps, and popular messaging platforms. Beyond these channels, though, providers hoping to remain competitive should look into the personalized communication potential of technology like Internet of Things healthcare devices (such as physical activity monitors), which are on track to becoming a $117 billion market by 2020, according to MarketResearch projections.

Rethink what customers want

For today’s healthcare insurers, tracking consumer health and fitness data is pivotal both to providing customers with a more personalized experience and fueling internal business intelligence efforts. But the rewards programs that insurers currently have in place aren’t giving customers what they want, namely, better rates and service. Healthcare insurers need to prepare for a future in which consumers choose their insurance provider based on the quality of its rewards program. When that time comes, it will be the insurers rewarding customers with meaningful incentives – not gift cards and redeemable points – that make the cut. “Just as the cookie isn’t a key driver for hotel choices, insurers will need to dig deeper to provide incentives that will move the needle for their business and customer relationships,” Hutchins says.

Prioritize secure technology growth

Across the board, healthcare insurance executives aren’t confident they have the technology in place to meet the needs of their customers. In an industry increasingly defined by digital engagement, it’s imperative that insurers have the right technology in place – as well as the people and processes to support it. They should begin by channeling resources into software and tools that focus on improving the customer experience, from predictive analytics programs to machine learning-based interactive communication platforms. To identify and successfully implement these tools, insurers will need to consider strategic personnel hires like customer experience designers and market data scientists. Organizations that don’t forge closer collaboration across IT, customer-facing, and marketing teams will be left with a fragmented, potentially vulnerable, customer experience.

For healthcare organizations, this won’t be an easy task due to a high level of regulation, an accumulation of technology debt, and the inherent conflict of interest between healthcare insurers and providers. “The healthcare industry is significantly behind the curve on technology innovation and collaboration efforts that improve the customer experience,” Hinde explains. And in an industry as susceptible to cyberattacks as healthcare, it’s important that organizations prioritize security alongside tech innovation. As insurers build out their digital experience, decisions and investments must be made with regard to data privacy, protection and regulatory compliance.

Consumers’ shift from wanting transactional, one-off brand relationships to collaborative, digital-driven interaction is revolutionizing how healthcare insurers and providers approach communication. By following these recommendations, providers can best equip themselves to accommodate a customer base that demands a continuous, personalized experience. Five years from now, healthcare companies will find themselves winning or losing customers based on the quality of digital interactions they offer. Providers that take proactive steps to evolve their approach now will be ready to meet this future.

Methodology

We conducted a survey of more than 1,300 healthcare consumers, and a roundtable of healthcare insurance executives, also referenced as healthcare insurers throughout this paper. The consumer survey included customers of all ages and income levels, while the executive survey spanned healthcare insurers with less than one million members to those with more than 15 million. We wanted to understand how today’s customers interact with their healthcare providers and insurers, and how these communication preferences are shaping the industry. Reaching out to customers, we learned about the technology-based communication channels they’re using and their feelings toward sharing information with their healthcare providers and insurers. Then, we turned to insurers to see if they’re prepared to meet their customers’ evolving needs. The study identified several key findings: