What We’ve Learned to Help Clients Generate NPS Growth!

At The Daniel Group, we truly have learned how to help our clients generate NPS growth. How do we know this? Since beginning our ExperienceConnect CX program, we have completed over one million customer surveys with B2B industrial customers. We started work with our first dealer in 2005 because management wanted to (1) know what customers thought about their service and (2) identify ways to improve it. Following are some things we have learned.

I want to focus on one significant client group and share what we have learned. This client group sells and supports complex and technically sophisticated equipment. The group comprises a network of value-added dealers in North America. Our survey feedback covers new and used product sales, product service, parts sales, and rentals.

NPS Growth Over Time

The chart shows the NPS for clients in this market since 2007. Currently, we are completing around 60,000 surveys for this client group annually. Overall, NPS has grown from 67% to 85% now.

NPS improvement has been relatively consistent over time. Why? First, there was strong buy-in from the dealer network to improve CX. OEM support and involvement happened later during this period. While the OEM has played and is playing an important role, this is still a dealer-led effort.

Along with buy-in, many dealers have taken actions such as implementing training programs for frontline personnel, investing in new technologies to improve response time, and making CX a more important priority in the organization. It is paying off through improved NPS.

NPS Growth Means Fewer Issues

No surprise here. When NPS goes up, the rate of issues decreases. The chart below shows the NPS score for 12 months for each client in this group vs. the rate of issues for each one. The rate of issues is simply the number of issues raised by customers vs. the number of surveys.

The statistical correlation between these two measures is significant. Fewer issues mean customers who are more loyal and more likely to refer.

Customers Will Let You Know What is on Their Minds

Customers will let you know what they like and don’t like. For example, we are averaging just over three customer comments per survey. Since most surveys are by phone, our team gets plenty of opportunities to hear what’s on customers’ minds. These comments are in addition to the numerical feedback customers provide.

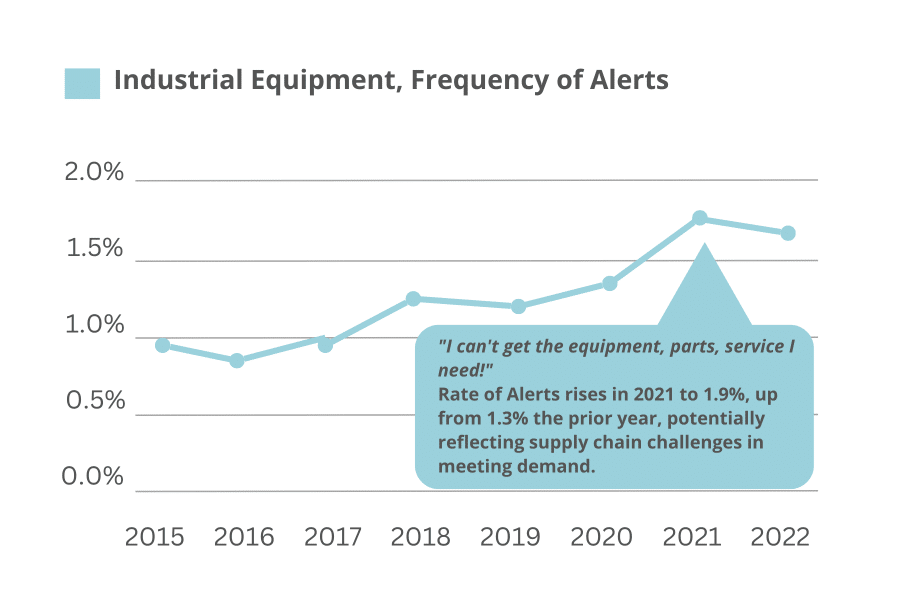

They will also let you know when they want to buy something. The chart below shows the trend in opportunities over time (as a percentage of completed surveys). Note that in 2020, with the advent of COVID and supply chain disruptions, customers started mentioning their needs for products and services. The change was significant starting in 2019, going from less than one percent of surveys with an opportunity to almost two percent in 2022.

The trend in issue frequency was different. Issue frequency increased beginning in 2021 but has gone down since. There was a consistent increase in issue frequency from 2015 through 2021. Comparing the increase in customer issues could suggest that service has declined, but the improving NPS suggests otherwise. I wonder if this dealer network has created an environment where customers feel more willing to bring up troubling issues. This dealer network may be creating an environment for their customers in which they are more willing to bring up problems because they feel the dealer will help solve them. Some food for thought!

The NPS Metric Consistently Improved

Several things stand out from our experience with this group of clients:

- The NPS growth has consistently improved. One of the keys to this improvement has been the client buy-in. While some clients are more passionate than others, they are all working to improve the experiences their customers receive.

- Better CX (higher NPS score) results in fewer issues, something assumed to be true. Our results show that clients with higher NPS generally have fewer customer issues.

- Customers do like to talk. The number of comments and the frequency customers mention an opportunity or an issue show this to be true. This suggests that customers are looking to their dealers for help solving their problems. They want a partner to help them solve problems.

I always welcome comments and feedback on my blogs. If you want to chat, please email me or give me a call at 704-749-5018.

Net Promoter®, NPS®, NPS Prism®, and the NPS-related emoticons are registered trademarks of Bain & Company, Inc., NICE Systems, Inc., and Fred Reichheld. Net Promoter ScoreSM and Net Promoter SystemSM are service marks of Bain & Company, Inc., NICE Systems, Inc., and Fred Reichheld.