Consumer Spending Expectations — Holiday Edition

Hindsight Is 20/20 — Foresight Is Priceless

How consumers spend, and on what, is of great interest to us; in that data lies kernels of insights that enable brands to shape their marketing strategies to maximize profitable growth and boost total shareholder return. To analyze consumer spending, we rely on data that economists at the US Bureau of Economic Analysis (BEA) compile (and do they compile a lot of it!). In September, we used this BEA data for “personal consumption expenditure” for the first half of the year to analyze consumer spending patterns in 2023.

Robust though that analysis is, there’s one problem: We’re looking in the rearview mirror and hoping to extrapolate trends from historical data, but with the holiday season upon us, we need to be looking out in front and out of our windshield.

So we’re not going to wait for Uncle Sam and his economists. Instead, let’s look at how consumers feel about spending their money during the next few months of 2023.

How Consumers Expect To Spend For The Rest Of 2023

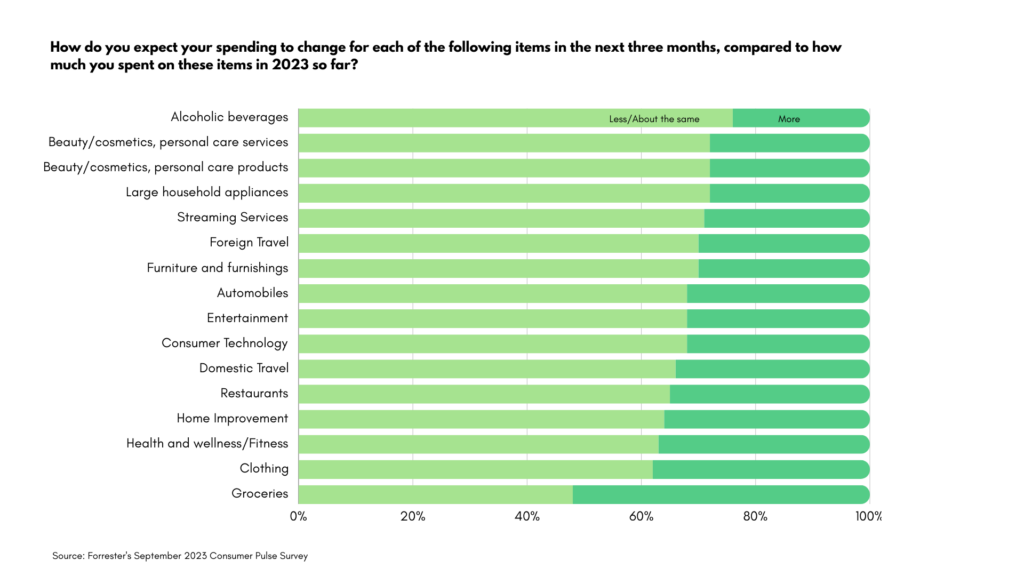

In our September 2023 Consumer Pulse Survey, we asked US consumers how they expected their spending patterns to change during the rest of the year. The results are shown below:

Keep in mind, however, the caveats that apply to this kind of data. Surveys have inherent biases, and their results must be interpreted in the correct context. For example, the data shows that the category with the lowest anticipated spending increase is alcoholic beverages — I will bet you my last bottle of Lagavulin that this won’t hold: It’s a festive season that will provide ample opportunity for merriment, and declaring an intent to drink more is contrary to a consumer’s need for “social desirability.” A good way to interpret the data is to look at relative spending projections rather than worry about the absolute numbers (we have had ample evidence of consumers underestimating their spending propensity).

Here are some of the takeaways:

- Back to the basics. The majority of consumers indicate that they will not increase their spending on practically every category we asked about. The singular exception was groceries. While inflation rates are down significantly on a year-over-year basis, there’s the lagging pocketbook perception that life’s essentials are still expensive. A similar argument can be made for clothes, although it is a distant number two after groceries.

- Staying close to home. Far fewer will spend more on foreign travel than on domestic travel. Revenge travel spending is likely cooling, but this pattern makes sense for US consumers who will likely be traveling within the country to be with friends and family during this time of the year.

- Beauty is not skin-deep. A much larger percentage of consumers say that they will increase spending on health and wellness/fitness than on beauty/cosmetics/personal care products and services. The focus on “inner beauty” is part of the post-pandemic awareness around wellness, especially a greater awareness of mental health issues.

- Streaming may be cooling. Streaming services fall on the lower end of spending growth among all the categories we measured. Consumers have already indicated the importance of price in securing their loyalty. Considering that most streaming brands have been actively increasing prices, if consumers were to make good on their expectations, we’d likely see rationalization of their subscriptions.

- Gift-wrap those gadgets. Roughly a third of consumers say that they will increase their spending on consumer technology. This is the time of year when the bottom of the tree (or wherever else you stash presents) is filled with gadgets galore. Apple, for example, hopes the holiday bump will help its new iPhone 15 break the sluggishness in US markets.

——————————

Want to learn more?

For our analysis of 2023 consumer spending, clients should read the research report, What US Consumers Are Buying: Implications For Growth Strategy.

For a deep dive into the holiday 2023 season from a retail perspective, clients should read A Retailer’s Guide To The 2023 Holiday Season, which helps retailers and brand manufacturers plan for the 2023 holiday season, including in areas such as marketing, customer service, fulfillment, and security.

To stay connected to these topics and my other research, go to my Forrester bio and choose “Follow.” If you are a Forrester client interested in discussing these topics, please schedule time with me.