The Time To Act On Inclusive Finance Is Now

“Soy mayor, no idiota” — “I’m old, not an idiot.” That’s the headline of a Change.org campaign launched by Carlos San Juan, a 78-year-old Spaniard who argued that the closure of bank branches and the forced migration of customers to digital banking were sidelining elderly and vulnerable customers. The petition, which asked for more consideration and better treatment of older customers, attracted nearly 650,000 signatures and forced Spain’s government and banks to respond. In February 2022, Spanish banks signed a protocol in which they pledged to offer better customer services to senior citizens by extending their branch opening hours and giving priority to elderly customers at certain times of day, improving training for staff, and simplifying the interface of their apps and web pages.

Financial services organizations have been slow to act on inclusion, and many customers like Carlos San Juan feel that they disregard their needs. The COVID-19 pandemic has accentuated financial exclusion, and financial services firms now face increased pressure from consumers, employees, regulators, and investors to embrace sustainable finance and make finance more inclusive. Ensuring availability and universal access to financial products is key to meeting the United Nations’ Sustainable Development Goals (SDGs) by 2030.

The good news is that inclusive finance — which Forrester defines as equitable access to affordable and valuable financial products and services that meet customer needs and are delivered in a responsible and sustainable way — presents a clear opportunity for financial services providers to build a more purpose-driven business model. It opens access to a large, untapped market. And it can help firms improve customer experience and earn consumer trust, gain a competitive edge, and achieve sustainable growth.

Financial Services Firms Must Act Across Products, Policies, And Processes

Over the past six months, I have interviewed executives at financial services firms to better understand their approach to inclusive finance. These conversations reveal that while some organizations have started taking action to deliver social impact, most still need to broaden their understanding of inclusive finance and the transformation that is required to drive real impact.

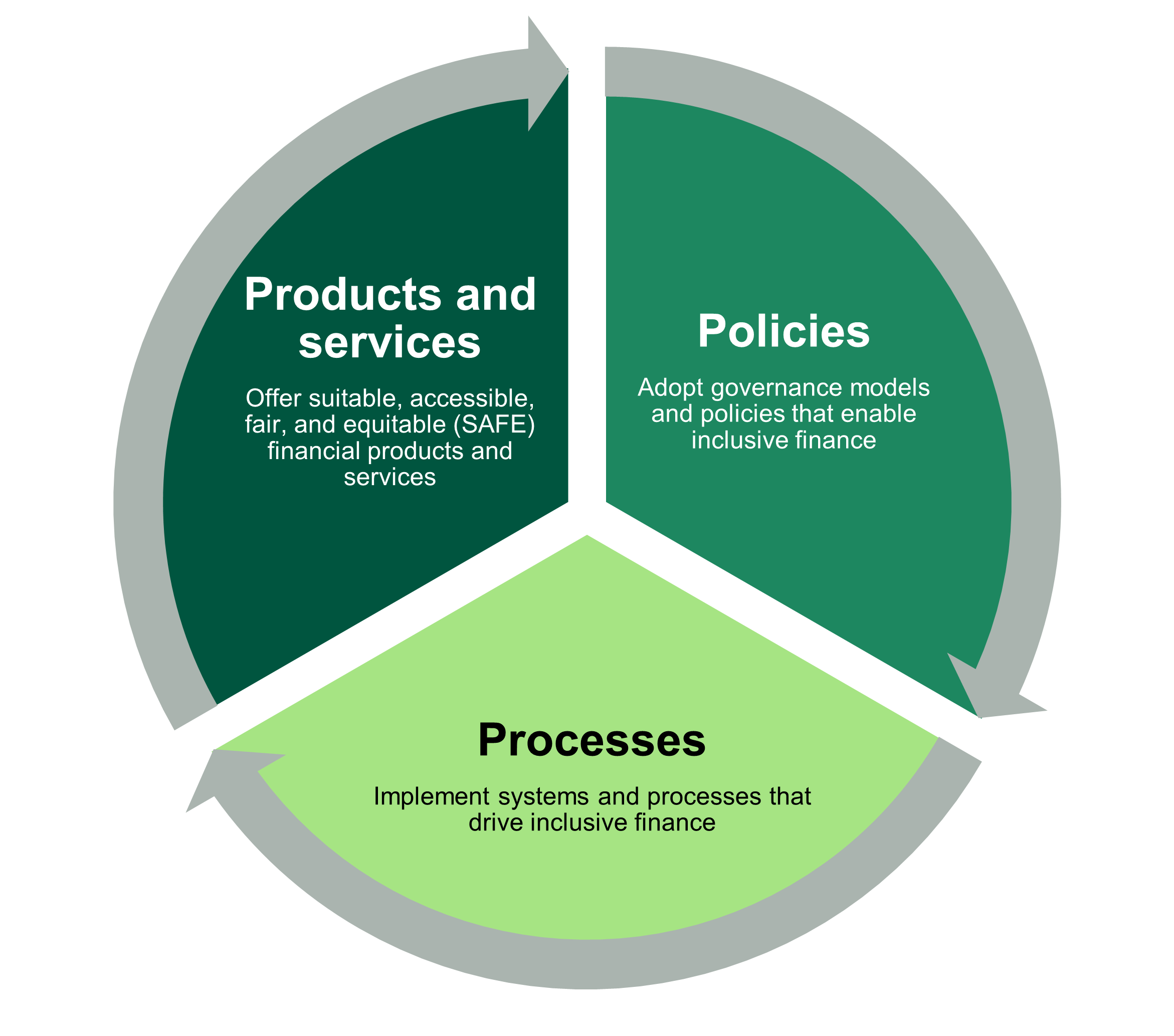

To successfully advance inclusive finance, firms must:

- Identify the barriers that lead to financial exclusion. When consumers or businesses are unable, reluctant, or struggle to access mainstream financial services, that results in financial exclusion. To develop effective solutions that address financial exclusion and, ultimately, reduce or close the inclusive finance gap, firms must first identify the factors leading to financial exclusion — many of which are tightly intertwined.

- Offer suitable, accessible, fair, and equitable (SAFE) financial products and services. Financial services firms should introduce financial solutions that are flexible and cater to customers’ specific needs, consider whether customers are aware of their products and able to access them, and be aware of bias or drivers of exclusion. In the UK, Starling Bank introduced connected cards to help customers connect a card to an existing account and give it to a trusted person to buy what they need on their behalf, without the need to exchange cash or bank details.

- Adopt governance models and policies that enable inclusive finance. To align their firm’s mission and corporate strategy with consumers’ needs and society’s goals as described in the SDGs, organizations need to adopt concrete actions, with a comprehensive set of rules and guidelines that define the responsibilities, processes, and targets. In 2021, a group of 28 banks founded the Principles for Responsible Banking’s Commitment to Financial Health and Inclusion. Some banks — such as, for instance, Erste Bank, which provides microfinance to entrepreneurs in rural and small urban areas across Central and Eastern Europe — are now tracking financial and nonfinancial indicators to assess the impact of their social banking program.

- Implement systems and processes that drive inclusive finance. To build deeper customer understanding and develop inclusive customer propositions, firms need to identify and act on the drivers of financial exclusion and incorporate ethics and inclusion into their design process. Italian bank Intesa Sanpaolo includes people with disabilities early in the design process to help create accessible digital experiences for visually impaired or color-blind customers.

My new report, The Inclusive Finance Imperative, offers guidance for financial services firms on how to devise an action plan to deliver suitable, accessible, fair, and equitable (SAFE) financial products and services.

I’m also speaking in London on June 22 at CX EMEA about inclusive finance and will be offering one-on-one analyst meetings. I look forward to seeing you there!