Cloud gaming has a bold future

By Maru Entertainment & Technology | August 4, 2022

The recent announcement from Samsung that its 2022 line of Smart TVs now have the capability for owners to cloud game on various services, including Xbox Game Pass Ultimate, represents a new stage in the development of cloud gaming as a mainstream consumer offering.

It’s been clear for a long time that gaming and tech companies view cloud gaming as a long-term revenue creator. Sony first launched their cloud gaming platform PlayStation Now in 2014, with Xbox Game Pass launching in 2017.

These have been joined by a slew of services from the likes of gaming hardware manufacturer Nvidia (2020), Google (2019) and Amazon (2021). Whilst subscription rates remain low for the various cloud services, exclusive research from Maru’s Entertainment and Technology group suggests that the industry is set for serious expansion over the next few years.

Key to this is the number of gamers who, after being told about Samsung’s cloud gaming upgrade to TVs, expressed a preference for foregoing the purchase of a console and would like to stream games via the cloud instead. Over a third of gamers said this would be their preference going forward, saving themselves money from buying an expensive console, and also saving the manufacturer money given the consoles are often sold at a loss.

Given that console makers have been beset with supply chain issues for critical components since the pandemic hit—inconveniently at the period of new systems being launched—cloud gaming may offer them a solution around the continued problems with supply meeting demand.

A key thing to consider here, however, will be the untethering of gamers from what has been a closed market. Gamers were locked into specific systems when console-based; if you lacked a console, you couldn’t play games developed for it. There is a possibility that cloud gaming will see brand loyalty diminish in the gaming sphere as barriers to switching rapidly erode.

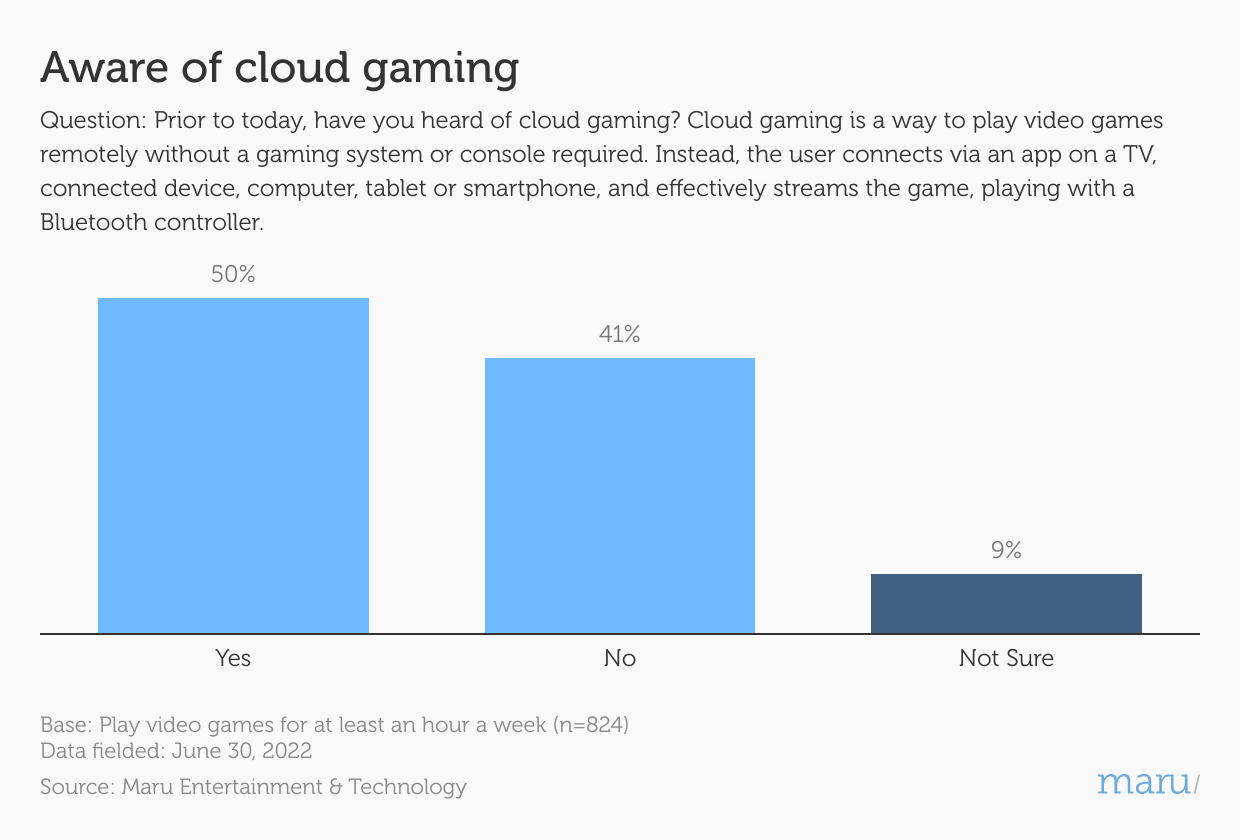

Half of gamers had already heard of cloud gaming before taking the survey, with one in ten unsure and two-fifths not aware. With the industry still in relatively early stages of development, this is to be expected, with awareness levels set to grow as broadband speeds increase. Another aspect to consider is a possible recession; the cheaper alternative of cloud gaming (effectively a monthly rent for access to gaming, versus the outright purchase of a console) may grow among some should the economy dip.

After being exposed to a description of cloud gaming, the response to the concept is overwhelmingly positive, with just under two-thirds of gamers saying they’d be interested in it. Key is the 1 in 3 who are very interested, suggesting that there already is a sizeable market to be targeting.

Interest among those who did not indicate that they were previously familiar with cloud gaming is solid, with half positive to the idea and one in five very interested. For comparison, 77% of those previously aware of cloud gaming had T2B interest, with 39% very interested.

When asked how interested gamers are in being able to use their TVs to cloud game, over a quarter said they were very interested in the idea. Note however that the number of those not at all interested is unchanged from when the concept was introduced at one in five, suggesting that cloud gaming will not be for everyone, and consoles will remain a gaming format for some.

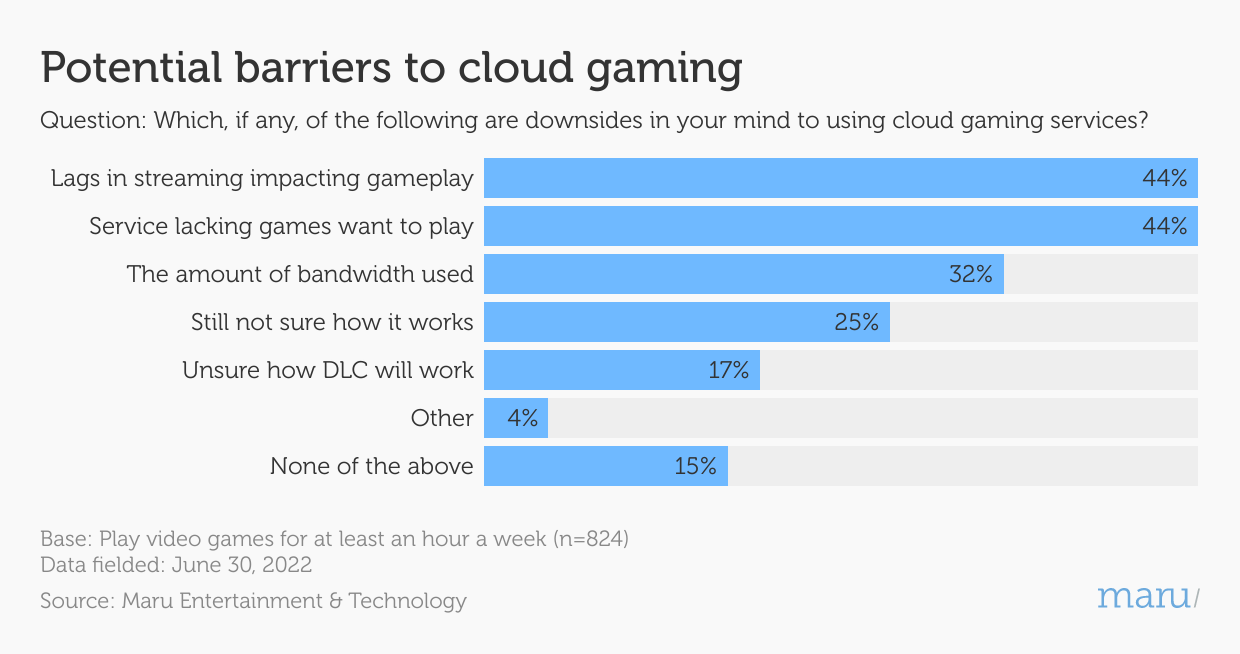

Concerns around the stability of streaming a game are one of the most common barriers, which makes sense as even a slight lag could make all the difference in both offline and online gaming. Concerns around the catalog available within a service also shine through as a key barrier, backing up the theory that cloud gaming could see a decline in brand loyalty within gaming.

With cloud gaming still in its nascent stage, some of the barriers should be expected to drop as education builds over time. What is clear is that it will be a growing market throughout the 2020s as more turn to it, either to replace consoles or to supplement what they already have (think if you have PlayStation but a game is exclusive to Xbox, now you don’t need to buy an Xbox to play it).

Maru’s Entertainment and Technology team will return to our survey at key points in the future to measure the growth within this industry. We will also be publishing an analysis of how cloud gaming interest and attitudes shift between key demographic age groups as a follow-up to this report.

If you are interested in exploring how Maru could help your business, please contact us today.