Lendingtree: transforming the loan market experience with Thematic insights

Back in 1996, Doug Lebda struggled to manually compare mortgage offers while searching for a home in Pittsburg. It was a classic problem of battling to make a decision because it was difficult to access and compare information. He decided to create an online marketplace for loans to solve the problem. He formed Lendingtree.

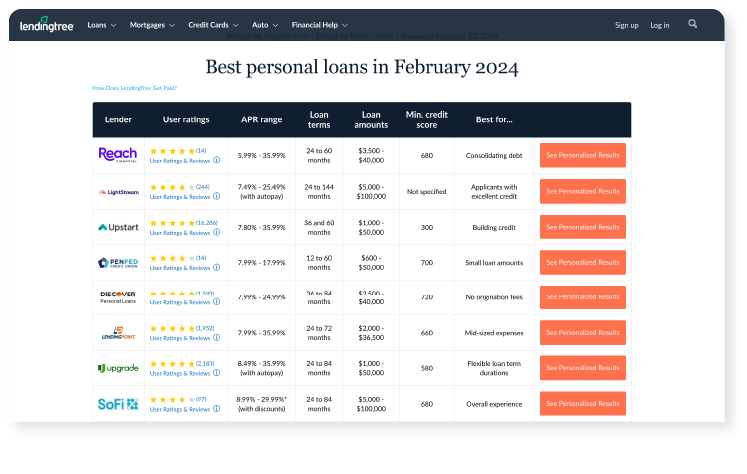

Over the last thirty years, Lendingtree has expanded from a marketplace for home lending to consumer lending and insurance too. They’ve simplified the historically complex loans landscape for consumers, while driving leads and loan value for lenders.

With decades of fintech experience and a ton of data, the company has learned a lot about listening to their audience and using the unstructured data to make better decisions.

We chatted with Lee King, to find out how they’ve been analyzing customer feedback data to drive better decision-making and revenue.

Getting in-depth insights from customer comments

As the Head of Insights, Lee needs to identify what matters most to customer segments and understand why. What helps a lender to sell a loan? What makes a consumer keep using the marketplace? What changes will make the most difference?

Drawing meaningful conclusions from over 20,000 comments in a 90 day period isn’t easy. This explains why they were early adopters of text analytics, to automate the heavy lifting, save time and get more value from their data.

After struggling to get useful text analysis insights from their customer experience management platform, Lee started to scour the market for alternatives. That’s when he came across Thematic. Lee was immediately hooked after the analysis “worked straight out of the box”.

Lee said Thematic delivers the best quality of insights from text comments at scale and is easier to use than other solutions. It does the best job of filtering out noisy data and extracting specific insights to act on. Plus they found Thematic easier to use than any of the other solutions they assessed.

Now they can see where best to focus their efforts and resources, and quantify the benefit from the changes they’ll make. The insights from Thematic influence the effectiveness of everything from communication campaigns to product features.

When they found that a ‘communication’ theme in their NPS surveys was disproportionately affecting their detractors, Lee used Thematic to hone in on the issue. He found that leads were receiving calls outside of normal hours because of the time zone differences in the US.

Lee said he could easily use Thematic's analysis tools to capture the size of the issue and determine the loan value affected - to assess the potential revenue gain and loss for lenders.

Lee used the related themes discovery tool to help Thematic’s AI build out the ‘Timing of Call’ theme. The business benefits were immediate:

- Discovery of a key revenue related issue

- Time saved quantifying the full extent of the issue

- Actionable insight on how to improve lead engagement and revenue opportunities

- Sets the sales team and their customers up for greater success

Effective data analysis with Thematic

Lee is still learning new ways to harness the power of all the rich insights in Thematic and how these can help different facets of the business. He delivers regular reports that highlight the key insights for the decision-maker. But he doesn’t believe in being a gatekeeper to insights. He gives decision-makers viewing access to Thematic to help build their understanding of issues and to dive into the customer verbatims directly.

“My approach is to teach them to fish, rather than give them the fish.”

With Thematic, Lendingtree saves hundreds of hours transforming customer survey data into specific insights to improve the marketplace experience

Are you looking for an easier and faster way to turn your open-ended survey responses into insights? Request a demo of Thematic today and discover how to turn your customer feedback into a competitive advantage.