Key SaaS Metrics that Matter

CSM Practice

FEBRUARY 8, 2023

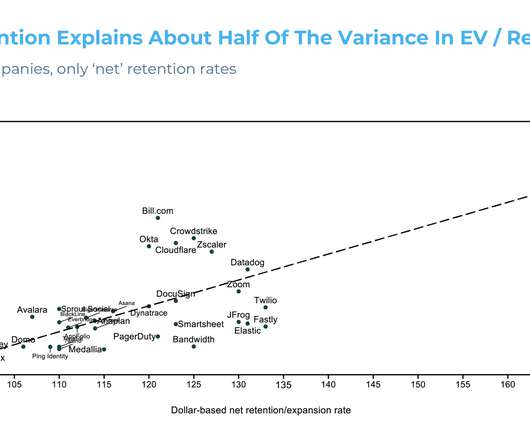

One of the best ways to grow your business is to track several customer success metrics and use this SaaS valuation data to make effective decisions. You can calculate the CAC by dividing your total sales and marketing expenses by the number of new customers you attract within a given time frame.

Let's personalize your content