Product survey questions are your best bet to really get inside your target users’ heads, helping you craft offerings that hit the mark. As a product manager, using these insights lets you build solutions that truly resonate with your audience and, ultimately, boost your business.

You can see a great example of this in this video:

Watch: How Tuttland Collected Valuable Data to Improve Marketing Strategies | ProProfs Case Study

In this blog, let’s explore why product surveys are key for growth and go through a detailed list of over 90 essential product feedback questions you can use throughout the product lifecycle.

These questions will help you understand your customers’ motivations, issues, and preferences, helping you tailor your products to meet their needs.

I’ll also share some best practices for creating targeted surveys that yield high-quality insights.

Ready to start?

What Is a Product Survey Question?

A product survey question is a tool for collecting targeted insights and feedback from both potential and existing users. It helps you understand what they like, what they don’t like, and what improvements they think could be made.

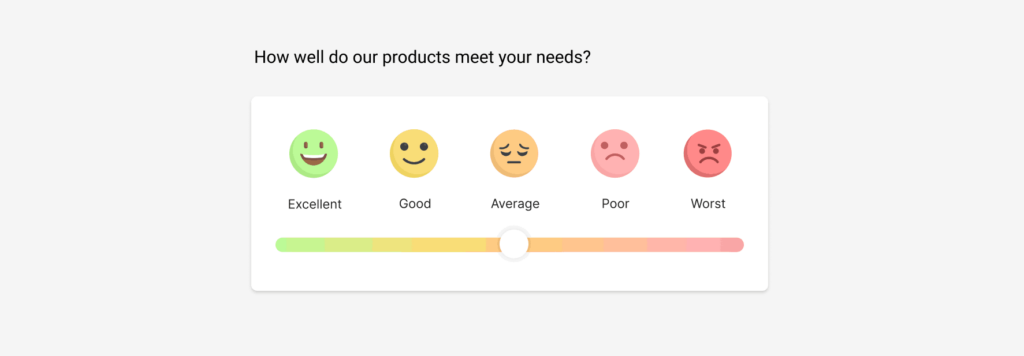

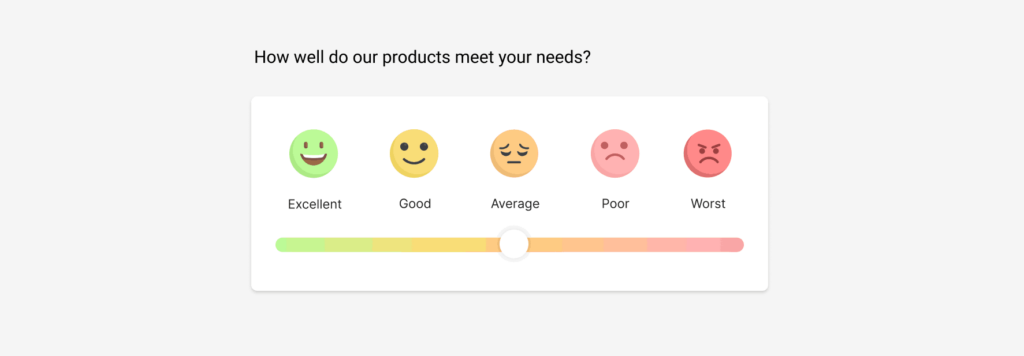

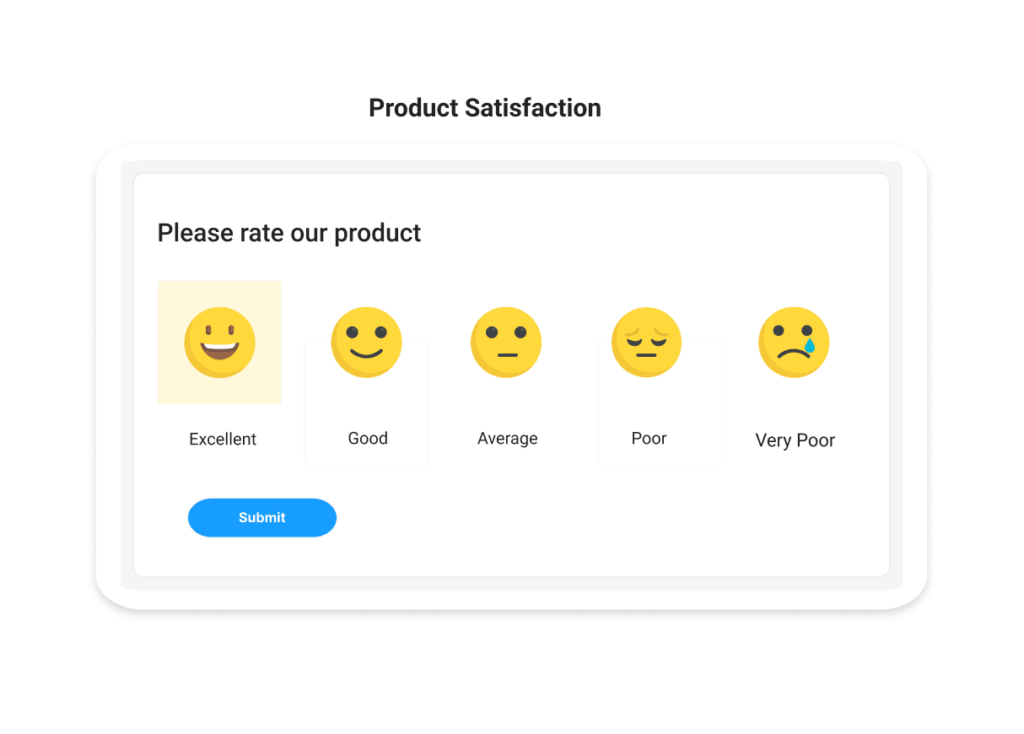

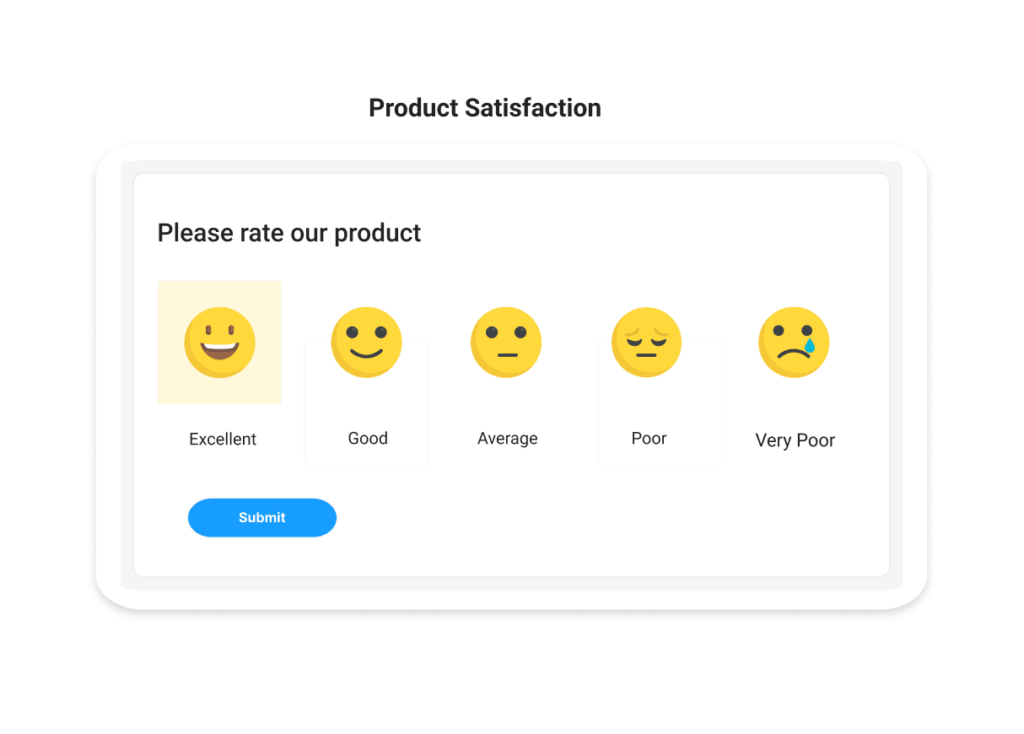

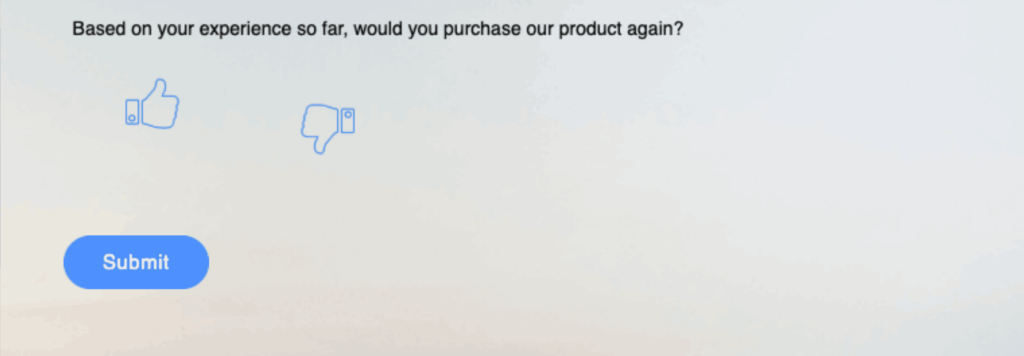

Essentially, these questions are a way to directly hear from your users and use their insights to enhance your product’s design, features, and overall usability. Here’s a typical product survey designed using ProProfs Survey Maker:

Product survey questions aim to collect feedback on a broad spectrum of various product aspects, such as:

- Usability

- Product UI

- Ease of use

- Features

- New upgrades

- General product improvement suggestions

Watch: How to Create a Survey Using ProProfs Survey Maker

What Are the Types of Product Surveys to Collect Customer Feedback?

When collecting customer feedback, different types of product surveys can provide you with a variety of insights. Knowing which type of survey to use and when can greatly increase your ability to gather meaningful data.

Here are some common types of product surveys that can help you capture customer feedback effectively:

Customer Satisfaction Surveys (CSAT)

These surveys measure how satisfied customers are with your product or a specific interaction and are great for getting at-the-moment feedback if you require it.

Typically, they ask customers to rate their satisfaction on a scale (for example, from 1 to 5) with a particular aspect of your product. For instance, after closing a customer service ticket, you might ask, “On a scale of 1 to 5, how satisfied are you with our product?”

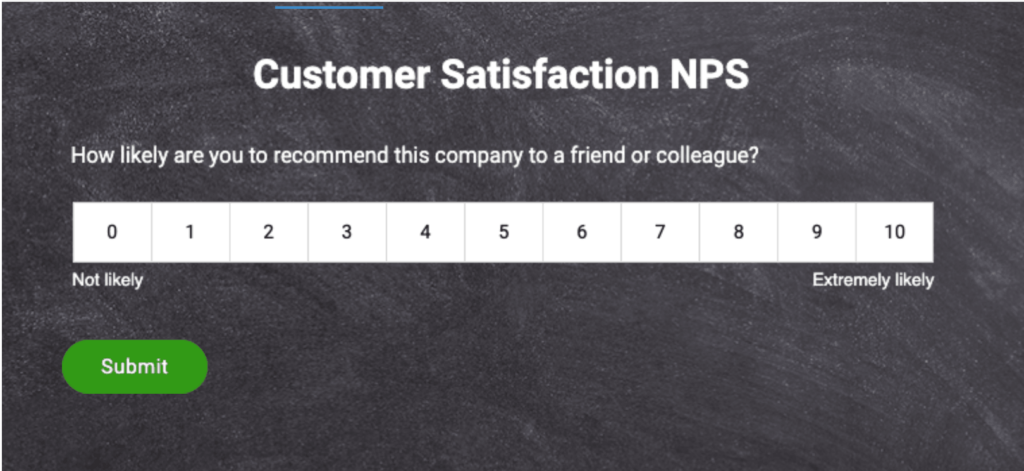

Net Promoter Score (NPS) Surveys

NPS surveys help you understand the likelihood that your customers will recommend your product to others.

This is usually measured with one simple question, “On a scale of 0 to 10, how likely are you to recommend our product to a friend or colleague?” This can tell you about overall customer loyalty and satisfaction over longer periods.

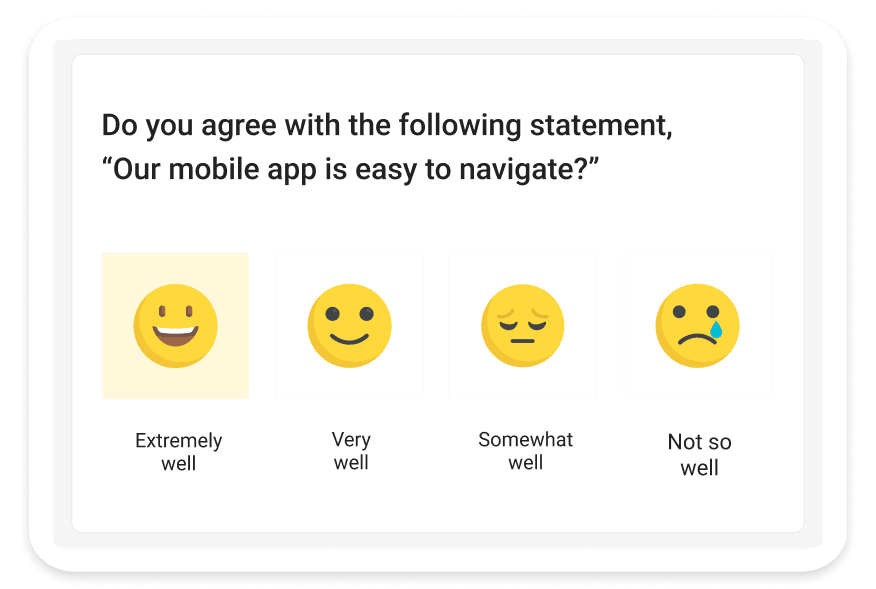

Product Usability Surveys

These surveys focus on how users interact with your product and how easy and intuitive it is to use. Questions might include, “How easy was it to navigate our product?” or “Did you encounter any problems while using our product?”

This type of feedback is invaluable when you are looking to improve your product’s design and functionality.

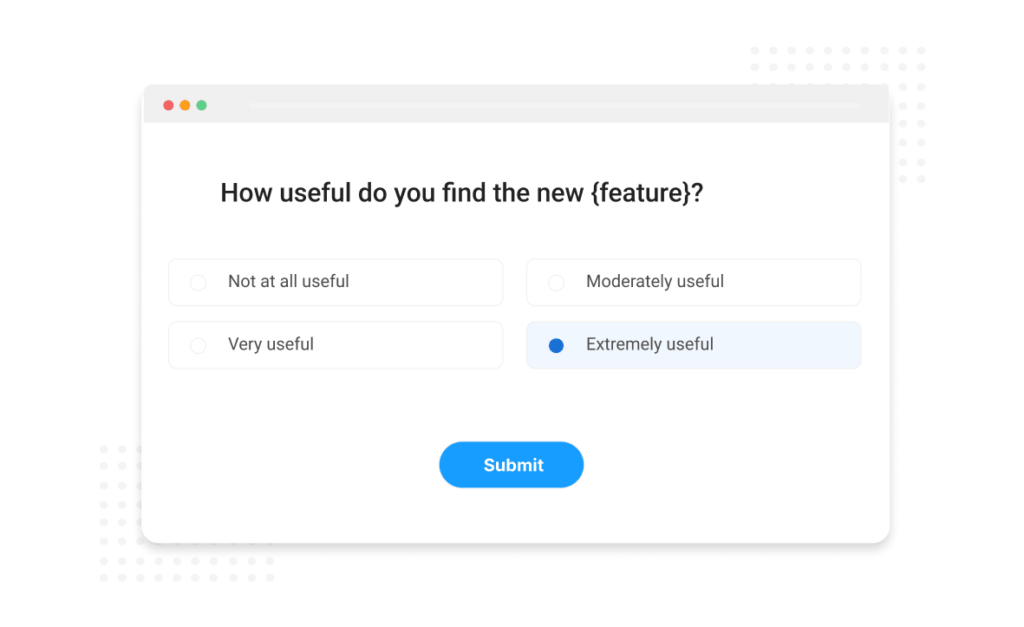

Feature-Specific Surveys

When you release a new feature or update an existing one, feature-specific surveys can help you understand how well the new feature is being received.

You might ask, “How useful do you find the new [feature]?” or “What improvements would you suggest for [feature]?” These surveys are particularly useful for iterative product development.

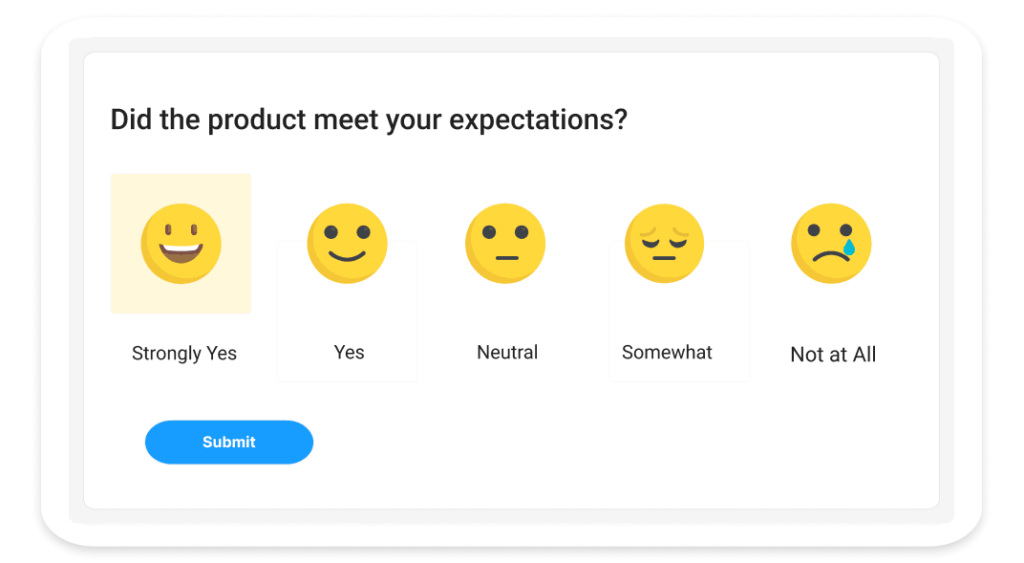

Post-Purchase Feedback Surveys

After a customer makes a purchase, sending them a survey can provide insights into their buying experience and initial product impressions.

Questions could include, “How was your shopping experience?” or “How does the product meet your expectations based on our description?” to let you understand the effectiveness of your marketing and sales strategies.

Longitudinal Studies

These are surveys conducted at regular intervals to understand how customer opinions change over time. This could involve periodically sending out NPS or CSAT surveys to see how improvements to your product affect customer perception.

90+ Best Product Survey Questions Examples To Ask

Here are some targeted product evaluation survey questions to ask your users. We have categorized the questions based on the product stage. You can always mix and match the questions to customize the product survey per your needs.

1. Ideation Stage Product Feedback Questions

The ideation stage is when you come up with the possible UI and features for the product. It’s the first step in the product development process. This stage is accompanied by the creation of design prototypes and wireframes to decide on the product’s informational architecture and other UI elements.

Here are a few product survey question examples to evaluate your prototypes:

- Was it easy to use the product?

- What do you think about the product navigation?

- Was it easy to locate the settings and features you were looking for?

- How easy is it to navigate the product?

- What’s your first impression of the product?

- How can we improve the product?

- What features did you find most useful in the product?

- Did the product meet your expectations in terms of functionality and design?

- How likely are you to recommend this product to others?

- What was your least favorite aspect of the product, and why?

- Are there any additional features or changes you would suggest to enhance the product?

2. Development Stage

Once you have changed the wireframes, it’s time to push the product solution into development. Here, you can use the product testing survey questions to improve the product, run pricing analysis, and find product opportunities.

Here are some product survey questions for the development stage:

- According to you, which feature would help to make the product better?

- Do you think the [price] is justified for the product?

- Name 3 three features that you like the most in the product.

- Would you purchase this product if it were available today?

- According to you, what should be the ideal price for this product?

- How likely are you to recommend the product to others based on the current features?

- What problems and issues are you looking to solve with our product?

3. Post-Release Optimization Stage

After launching the product, assess if it meets customer expectations. You can use product feedback surveys to see what makes your product better than the competitors, which features work the best for users, and more.

Here are some good product survey questions for post-release optimizations:

- Which other product options did you consider before buying our [Product name]?

- Have you come across a product with [feature name]?

- How was your experience after you started using our product?

- What made you choose our [product] over other similar products?

- Considering our competitors, is our product better, worse, or about the same in terms of quality?

- How does the design of [product name] meet your expectations?

- What aspects of [product name] would you like to see improved in the next version?

- How does [product name] perform under different conditions or environments?

- Has [product name] helped you solve any specific problems? If so, which ones?

- How likely are you to purchase future products from us based on your experience with [product name]?

4. Collecting Feedback on New Product Features or Updates

Product innovation is an ongoing process, so when you add a new feature or release an update, it’s important to gather feedback to gauge its effectiveness. You can see how people feel about the new feature. Was it able to improve the overall product experience?

Here are a few new product survey questions examples to evaluate your feature releases:

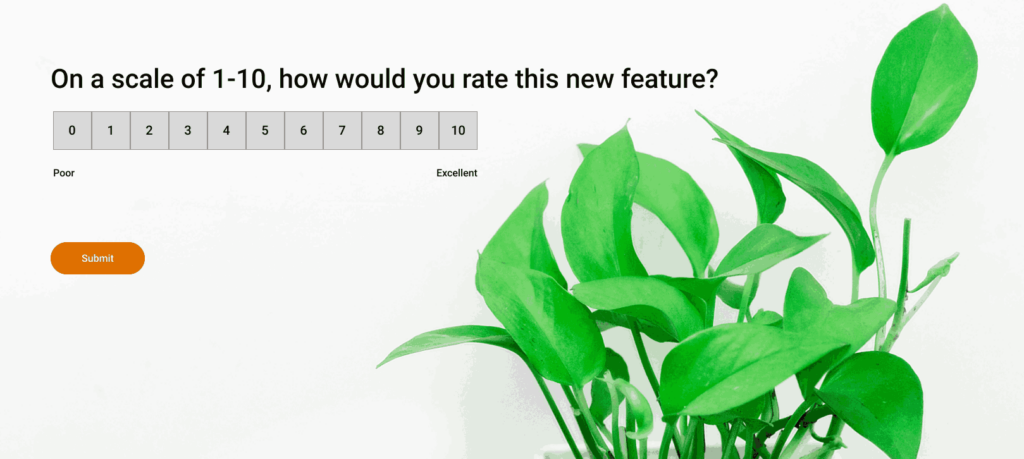

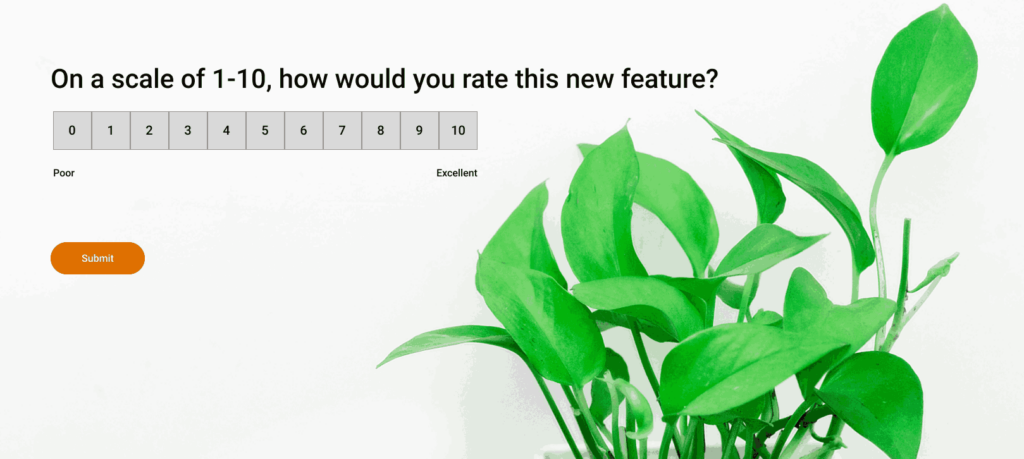

- On a scale of 1-10, how would you rate this new feature?

- Please share your suggestions on improving the [feature name] further.

- Would you recommend [product name] to others after adding [feature name]?

- What feature should we build next?

- How does this new feature enhance your overall experience with [product name]?

- What specific benefits have you gained from using this new feature?

- Were there any challenges you faced while using this new feature?

- How intuitive did you find the interface for this new feature?

- How well does this new feature integrate with the existing functionalities of [product name]?

- Could you describe any specific scenarios where this feature proved particularly useful or fell short?

Watch: How to Collect Customer Feedback

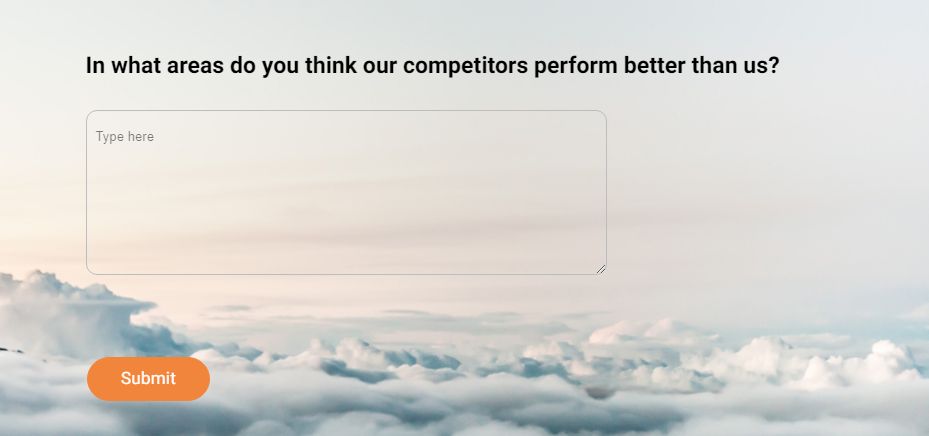

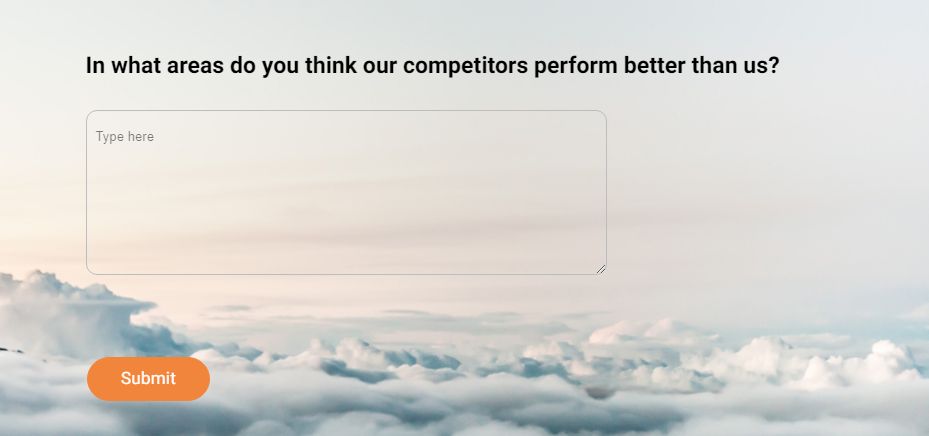

5. Feedback Questions for Comparison to Competitors

These survey questions are designed to gather insights about how your products, services, or overall customer experience compare to those offered by your competitors. This type of feedback is crucial for identifying your unique strengths and areas where competitors might be outperforming you, allowing for strategic adjustments to enhance your market position.

Here are 10 sample questions that could be included in such a survey:

- How do our products/services compare to those of our competitors?

- What features do you prefer in our products over our competitors’?

- In what areas do you think our competitors perform better than us?

- How would you rate our customer service compared to that of our competitors?

- What made you choose our product over a competitor’s?

- What do our competitors offer that you wish we did?

- How likely are you to continue choosing our products over our competitors’?

- Can you identify any unique benefits our products provide over our competitors’?

- How do our prices compare to those of our competitors for similar offerings?

- What improvements would you like to see that would make us stand out against our competitors?

6. Pricing Evaluation Feedback Questions

Pricing evaluation feedback questions are designed to assess customer opinions and perceptions about the pricing structure of your products or services. This feedback helps businesses understand whether their pricing aligns with customer expectations and perceived value, offering insights into potential adjustments to maximize profitability and market competitiveness.

Here are 10 sample questions to include in a pricing evaluation survey:

- How would you rate the value for money of our products/services?

- Do you believe our pricing is fair compared to the quality provided?

- What is your perception of our pricing compared to our competitors?

- Would you be more likely to purchase if we adjusted our prices?

- How does our pricing influence your decision to purchase from us?

- What pricing model do you think works best for our type of products/services?

- Have our price changes affected your likelihood of future purchases?

- What price range do you consider reasonable for our products/services?

- How satisfied are you with the cost versus the benefits of our products?

- Would you recommend our products/services based on our current pricing?

7. Gauging Product Experience

When the product is in the market for a substantial amount of time, it’s time to stay ahead of the curve and increase profits. For this, you need to gauge the users’ experience and make improvements to beat the competition.

Here are some product satisfaction survey questions to gauge overall user experience:

- Overall, how satisfied are you with the [product name]?

- Which features do you like the most in our product?

- What issues did you face when you started using the product?

- Is the [product name] worth the price?

- Which features do you like the least in our product?

- How can we make the product better?

- How would you describe the overall product experience?

- How likely are you to buy again from us?

8. Mapping Product Churn

Let’s complete the product cycle with churn-based feedback. It’s when a user decides to stop using the product.

But why should you survey these users?

Because they provide insights into why people would leave your business and go to the competitor.

These product feedback survey questions aim to explore the reasons for user attrition and identify potential ways to mitigate it.

For example, if a user states that they find the product pricing high and that’s why they have decided to cancel the subscription, your sales team can devise a custom plan for the user to retain them.

Or, if the user is looking for specific features not currently available in the product, you can offer them customization services to add the requested feature.

Here are a few churn-related product feedback survey questions to ask users:

- How would you rate the overall experience with the [product name]?

- Based on your experience, how likely would you recommend the [product name] to a friend or colleague?

- What is the reason for your answer?

- What are your reasons for canceling the subscription?

- What features are missing in our product?

- Is there anything we can do to stop you from leaving?

9. Feedback Questions for Market Research

These questions aim to delve into the consumer psyche, revealing motivations, habits, and unmet needs. They offer a comprehensive view of consumer behavior, preferences, trends, and broader market conditions. Market research surveys also help companies make informed decisions about product development, marketing strategies, and overall business direction. It also guides strategic planning, helps identify competitive advantages, and fosters innovation.

Here are some sample questions you can include in a market research survey:

- How do you typically learn about products or services in our industry?

- What factors are most important to you when choosing this type of product/service?

- Which brands do you consider when making a purchase in our industry, and why?

- What trends have you noticed recently in our industry?

- What are your biggest challenges or needs related to our industry’s products/services?

- How do you feel about the current options available in the market?

- What would encourage you to switch from your current provider/brand to another?

- How often do you use products/services from our industry?

- What features or benefits are you looking for that are not currently offered?

- Can you describe a recent experience you had with a product/service in our industry?

Why and When Should You Run Product Surveys?

One of the biggest reasons for collecting product feedback is to align your product with customers’ expectations. Whether you are building a new product solution or optimizing an existing one, you need to know:

- What do your customers want?

- How do they feel about your current products?

- What issues do they face while using the product?

- Are they satisfied with the current solution?

- What are the main areas of improvement to enhance the overall product experience?

Product feedback survey questions extract these answers so you can push the insights into your product development and optimization cycle.

You can run surveys at every stage of your product lifecycle, i.e:

- Ideation stage

- Development stage

- Post-release optimization stage

- Churn

For example, during the ideation and prototyping stages, you can use product feedback to gauge if the informational architecture is easy to understand and navigate. You can also track any redundant steps in critical user flows. It would help you release an optimized product.

5 Best Practices for Creating Product Surveys

Given below are some strategies that you can use to make your product surveys more effective:

1. Set the Goal of Your Product Survey Campaign

There are hundreds of questions to ask about your product. We know it’s tempting, but overwhelming the respondents with too many questions can lead to user frustration and survey abandonment.

So, first, decide what you want to measure or track with a particular product survey:

- Do you want to gauge your product’s NPS or CSAT ratings?

- Do you want to collect data on users’ preferences and expectations?

- Do you want to know the users’ consensus on a newly added feature?

You can then choose the questions accordingly.

Watch: How to Calculate Net Promoter Score

Having a clear goal will also help you target the right audience. For example, if you are looking to gauge the overall product experience, regular users would fit the target audience more than new users.

2. Avoid Double-Barreled Questions

Double-barreled questions tend to ask two different questions in one. One may think it’s an excellent way to reduce survey length, but respondents may have different opinions about each question.

Here’s a question: How satisfied are you with our product onboarding and customer service teams?

The user may be delighted with the onboarding tour but dissatisfied with the service team. However, if they have to choose only one option from predefined answer choices, the data reliability will be reduced.

Instead, split the question into its individual components to gather meaningful feedback on both:

- How satisfied are you with our product onboarding process?

- How satisfied are you with our customer service team?

You can weed out such survey issues by testing them before sending them out.

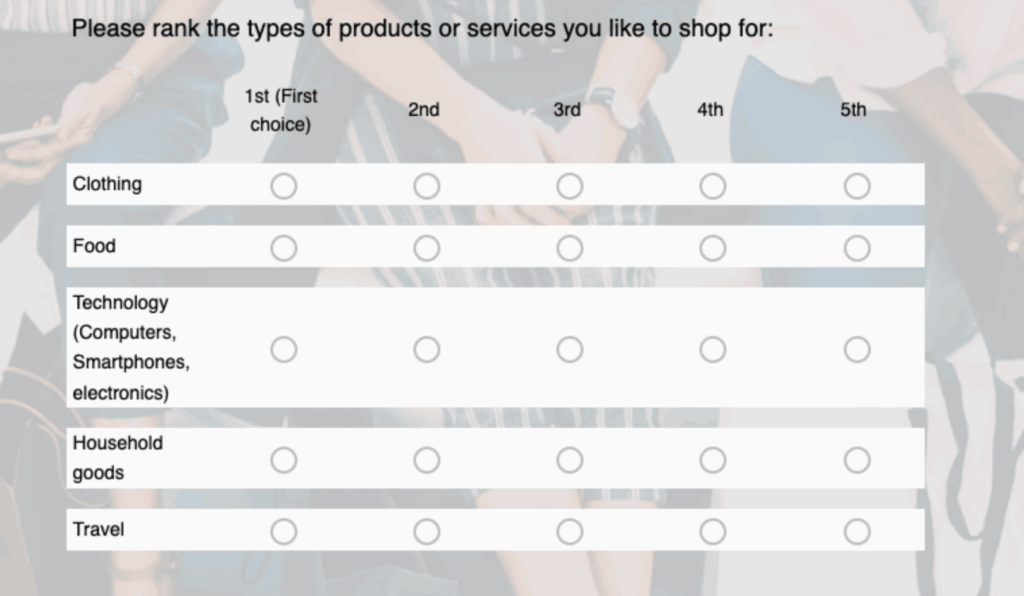

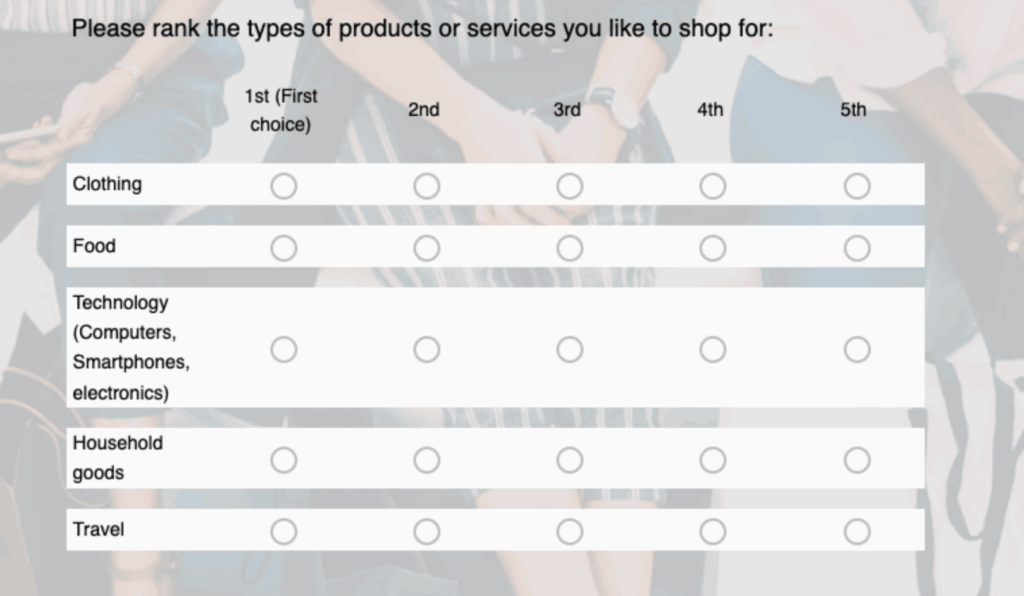

3. If Possible, Split the Matrix Question Into Individual Questions

A matrix-based question is another great way to reduce the survey length, but it carries the risk of straight-lining, where the respondents give identical answers to all the individual questions.

It would dilute the data quality, making the results unreliable. So, it’s better to split the matrix into individual questions to improve the data quality.

Here’s an example of how you might initially design a matrix-based question and then split it into individual questions to reduce the risk of straight-lining:

Matrix-Based Question Example:

Please rate your satisfaction with each of the following aspects of our service using the scale provided. Each item should be rated from 1 (Very Dissatisfied) to 5 (Very Satisfied):

| Aspect | 1 | 2 | 3 | 4 | 5 |

| Product Quality | |||||

| On-time Delivery | |||||

| Customer Support Responsiveness | |||||

| Price Satisfaction |

Please mark the appropriate box that best describes your level of satisfaction for each aspect.

Split into Individual Questions:

- How satisfied are you with the quality of our product? (1- Very Dissatisfied, 5- Very Satisfied)

- How satisfied are you with the timeliness of our delivery? (1- Very Dissatisfied, 5- Very Satisfied)

- How satisfied are you with the responsiveness of our customer support? (1- Very Dissatisfied, 5- Very Satisfied)

- How satisfied are you with our pricing? (1- Very Dissatisfied, 5- Very Satisfied)

This approach not only helps in avoiding straight-lining but also allows respondents to consider each aspect more thoughtfully, potentially yielding more reliable data.

4. Leverage the Foot in the Door Principle

The foot-in-the-door strategy states that people are more likely to comply with your bigger requests if you can make them agree to complete smaller ones first. You can structure your product survey questions to leverage this compliance technique.

Start with closed-ended questions like yes/no or a rating scale to ease the product users into your surveys. Then, you can add open-ended questions to collect more in-depth insights about their product experience.

Pro tip: To keep the survey short and effective, add one open-ended question for every 3-4 closed-ended ones.

5. Consider Offering Incentives to Boost Response Rates

For the insights to be reliable, it’s essential that the survey responses reach the required sample size. Offering incentives to the respondents is one way to improve response rates.

It can be a small discount code, limited access to premium features, free shipping, or complimentary products.

But be careful with this strategy, or it may backfire. People may fill out the survey randomly just to collect the incentive. It would decrease the data reliability.

You can add screening questions at the start of the survey to disqualify irrelevant respondents.

Pro tip: Use question branching to add screeners and redirect the respondents to the next question.

Watch: How to Customize & Add Branding to Your Survey

Ask the Right Product Survey Questions to Drive Growth

Now that you are armed with insightful questions, it’s time to design a closed feedback loop.

Here are my two cents to get started.

Start by investing in robust survey management software. Look for a tool like ProProfs Survey Maker with multi-channel reach, powerful analytics, and ease of use.

Next, set up survey campaigns to collect insights for each product development and optimization stage. Remember to incorporate the best practices and test the product survey questions before sending the survey.

The most crucial step is to periodically pull actionable insights from the raw data and channel them to the right teams. It would help to build personalized campaigns, design product roadmaps, and resolve issues to improve the product experience.

Then, repeat the cycle.

Get started free today, or sign up for a demo.

Do you want a free Survey Software?

We have the #1 Online Survey Maker Software to get actionable user insights.