Selling to your existing customers is far easier than acquiring new customers. The general rule of thumb is it costs 5x as much to generate a new customer than to sell to your existing customers.

That’s not all.

Your current customers are also more likely to spend more. One study says that existing customer order value is 31% higher than the order value from a first-time buyer. The purchases loyal customers make from your company can add up to a significant value over time. When distilled down to a number, this is called their customer lifetime value (CLV).

To evaluate the success of your company and its trajectory for long-term, healthy growth, businesses use the customer lifetime value formula to make this crucial calculation.

In this guide, we will cover:

- What is customer lifetime value?

- Why is customer lifetime value important?

- How to calculate customer lifetime value

- How to increase customer lifetime value

What is customer lifetime value (CLV)?

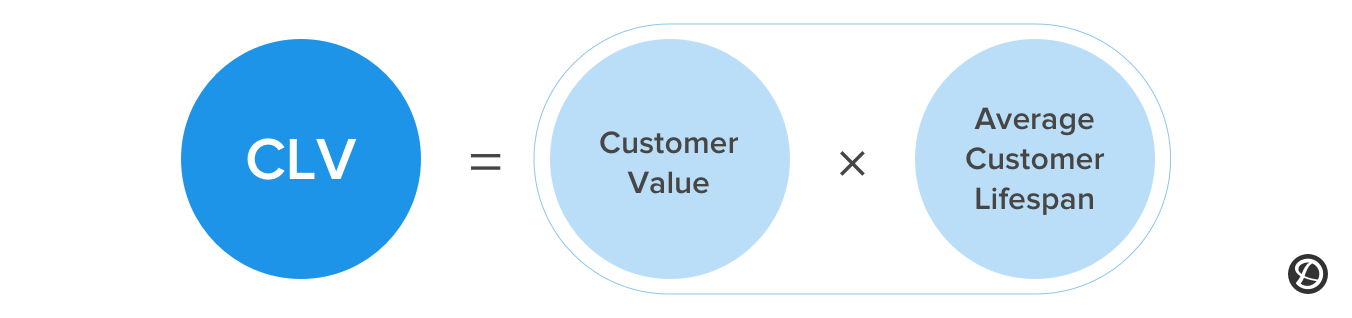

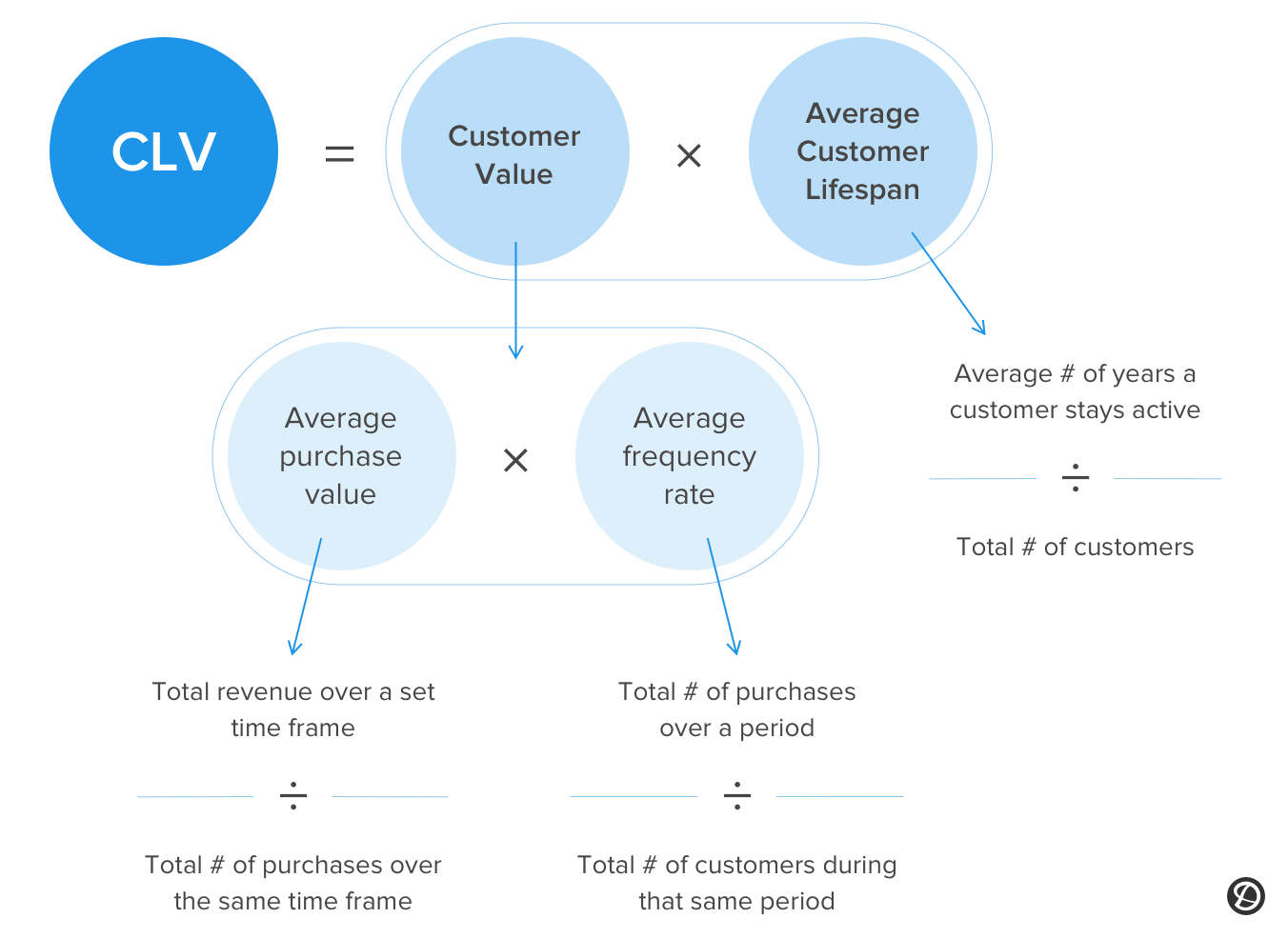

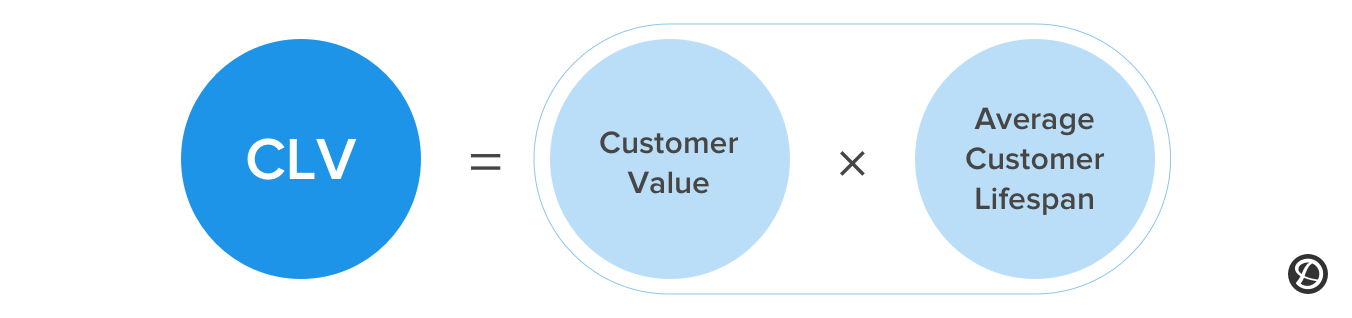

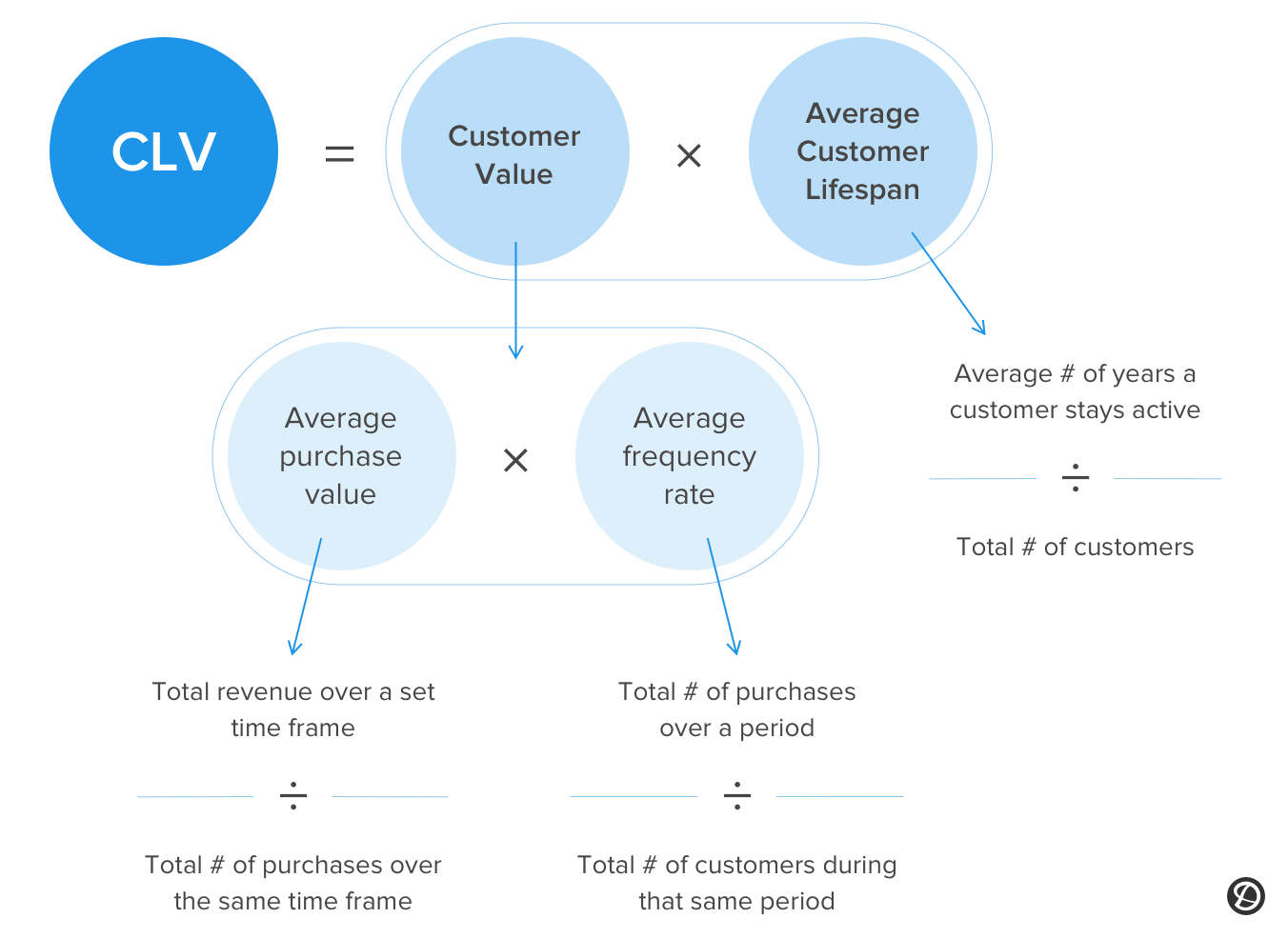

The customer lifetime value formula will tell you what the average customer is worth to your business throughout the course of the relationship. The typical formula used to calculate customer lifetime value is Customer lifetime value = customer value x average customer lifespan.

Customer value is the average purchase cost and frequency of their purchases, while the average customer lifespan is the average number of years a customer stays active divided by the number of total customers. The complete customer lifetime value formula is as follows:

It’s essential for customer success and support teams to understand CLV because it’s always less expensive to maintain an existing relationship than to create a new one.

Increasing the value of your customers is the best way to supercharge your business growth. Using the CLV formula correctly can help you develop strategies to get new customers and improve your average lifetime value of a customer.

Why is customer lifetime value important?

Customer value is at the heart of any stable business. The customer lifetime value formula is essential if you’re looking to achieve substantial growth patterns.

It’s a long-term calculation that measures how sustainable your business model is. If you have a low lifetime value, your business may be failing to deliver on customer expectations. It could also mean you’re spending much more than you need to maintain your margins.

So, why is lifetime value so significant?

1. It impacts your bottom line

Total consumer value has a direct impact on profitability. Businesses focusing entirely on lead generation and conversions pay the high cost of acquiring these customers. It also means you’re getting a smaller margin for every sale.

Knowing what your customer lifetime value is versus your customer acquisition cost can shine a light on how you need to adjust your strategy to bolster margins: optimize your lead generation program, focus on delivering more value for your customers, or both.

2. It steadies your cash flow

A steady stream of orders from your existing customer base stabilizes your cash flow. It’s no secret that cash flow is a company’s biggest challenge. According to one U.S. bank, 82% of failed businesses cited cash flow as a factor in their collapse.

Keeping your eyes on the readouts from a CLTV calculator makes it easier to project your income and stay on top of your bills.

3. You’ll practice more intelligent acquisition

If you know your average customer will spend $100 with you instead of $10, you can tweak your acquisition budget accordingly.

Companies whose customers spend an average of $10,000 can afford to allot much more to their allocation budgets than businesses with customer values of just $200.

Adjust what you spend and how you spend it based on the projected value of a customer. You’ll find yourself in the red soon enough if you’re paying $50 per acquisition and your customers are only spending $25.

4. You can achieve more growth

Your priority as a business is growing. Using the LTV calculation to find out more about your customers can allow you to increase your margins.

Companies with bigger margins can react by reinvesting that money and adding a touch of rocket fuel to their growth.

5. You’ll find out what your customers think

What does your lifetime value tell you about your customers?

If you’ve got a high figure, it tells you that your customers love to shop with you. It demonstrates that they’re satisfied with the service you offer. Most importantly, a high lifetime value shows a degree of brand loyalty.

It’s important to note that customer lifetime value is different from loyalty and satisfaction metrics like Net Promoter Score (NPS) or Customer Satisfaction Score (CSAT) because customer lifetime is based on revenue specifically, whereas other customer satisfaction metrics are based on sentiment and promise.

How to calculate customer lifetime value

The customer lifetime value calculation is not a straightforward step-by-step process. There’s more than one way to discover the value of your average customer.

In this section, we will discuss the different ways you can put an accurate dollar figure on your customers.

Calculating CLV: general formula

To begin, the most basic customer lifetime value formula of all is as follows:

Customer lifetime value = (customer value x average customer lifespan)

The simplest way to find the right numbers to plug into this formula is to calculate the average purchase value of your customers and multiply that number by the average number of purchases.

For the second part of the formula, you need to dive into your figures and calculate how long the average customer has a relationship with your brand.

Once you have these two figures, multiply them together to get the lifetime value of your customers.

Let’s look a bit deeper at each of the componenets of the customer lifetime value formula next.

Lifetime value formulas

You might choose to use different calculations for your CLV for various reasons. It’s useful for businesses who want to re-examine their customer retention strategies or gauge the financial viability of their operations. True data-driven companies don’t predict what customers find valuable about their brands. They find the truth.

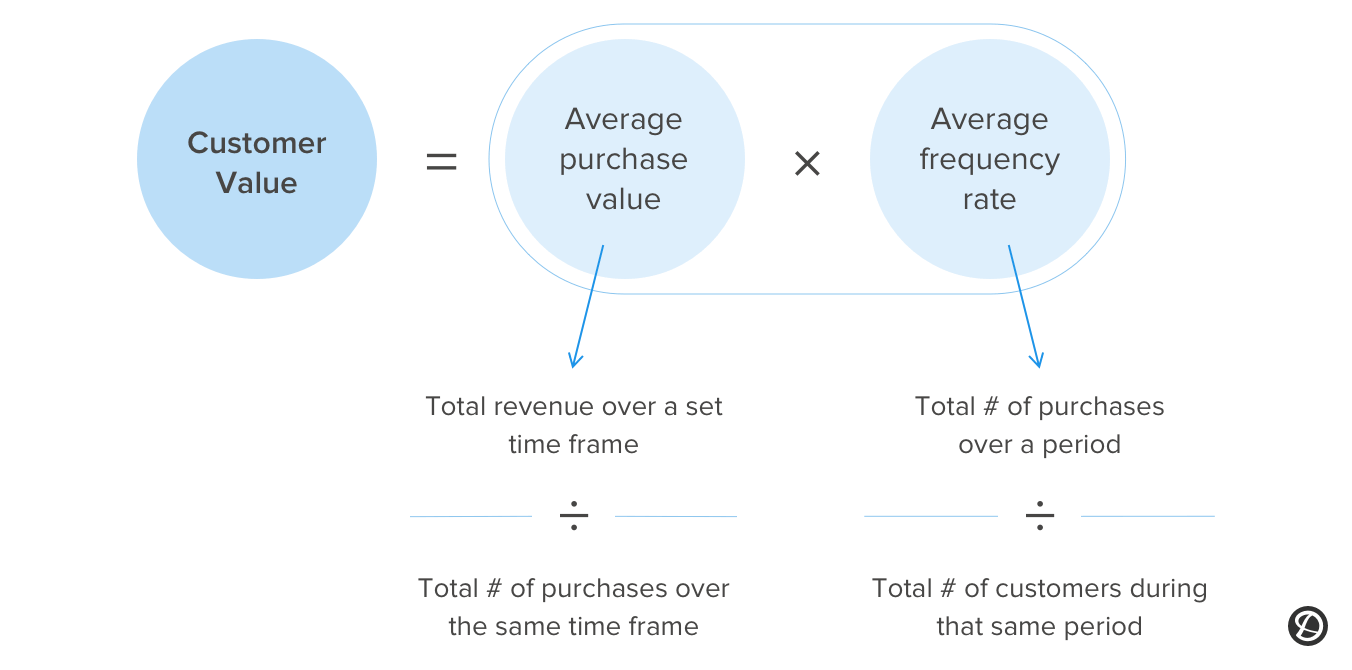

To calculate Customer Lifetime Value, you’ll need to calculate total customer value first.

Total customer value

To find the total value of your customers, you’ll need to calculate the average purchase value (or how much a customer spends on an average order) and the average frequency rate first. Calculate those two variables with the formulas below before multiplying the average purchase value by your average purchase frequency rate.

Total customer value = (average purchase value x average frequency rate)

You might find that the value of your customers is higher or lower than you think. Comparing value to previous periods can be extremely helpful for tracking how you’re serving your existing customer base.

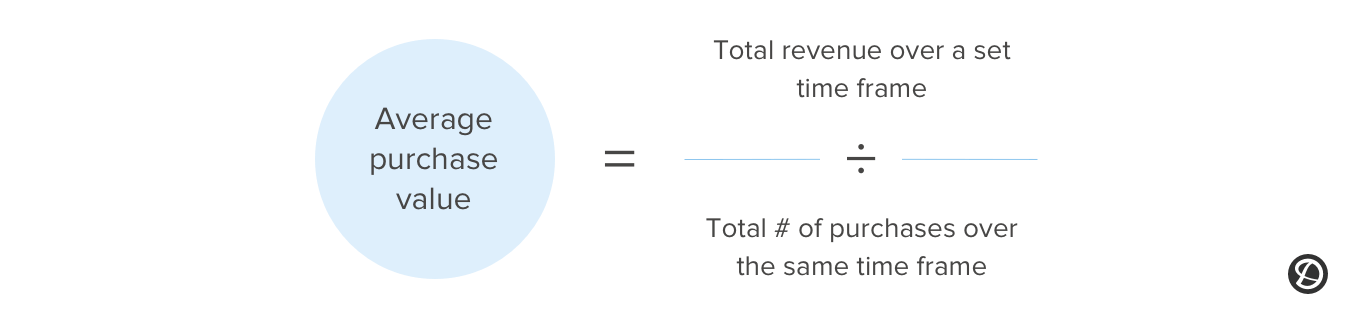

Average purchase value

If you want to find out the average purchase value for your business, you need to divide the total revenue of your company over a set period by the number of purchases over the same period.

Average purchase value = (total revenue over a set time frame / number of purchases over the same time frame)

Most companies will use a year’s worth of data, but you can also do it by quarter. Finding this number allows you to tell how much the average customer spends on each purchase. It’s also an easy way to find out how big your customer’s baskets are.

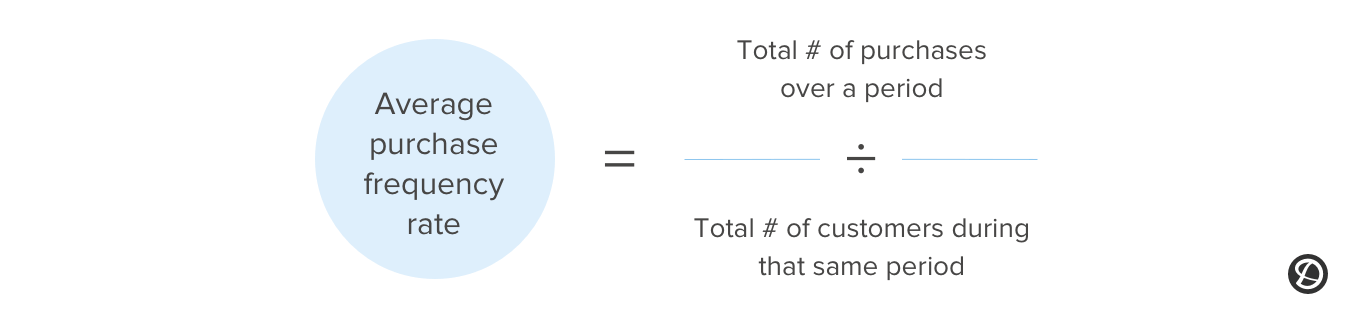

Average purchase frequency rate

Finding the average purchase frequency rate tells you how often your customers are making a purchase, giving you some insight into consumer buying behavior and how you might be able to influence it. To find this number, divide the total number of purchases over a period by the unique number of customers.

Average purchase frequency rate = (total number of purchases over a period / number of customers during that same period)

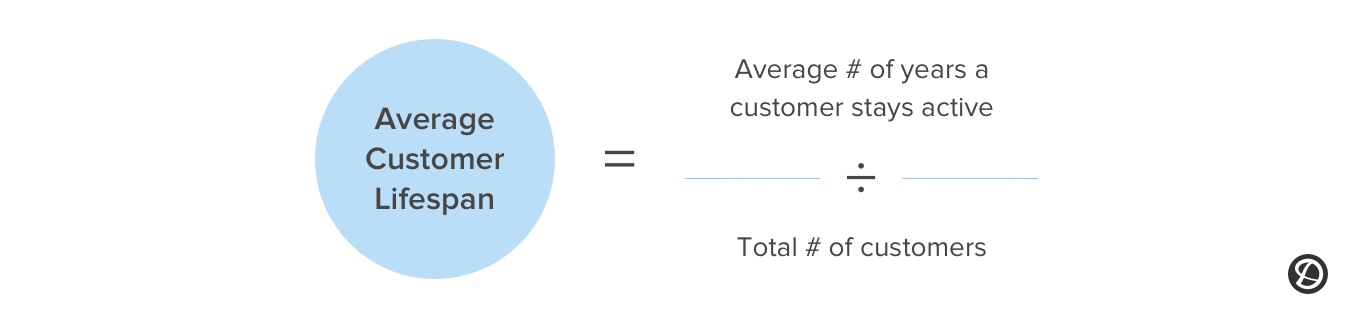

Average customer lifespan

Customer retention is essential to the success of any business. The longer you hold a customer, the greater their lifetime value. Approximately 82% of companies say that retention is more valuable than acquisition.

To work out the average customer lifespan, take the average number of years a customer stays active and divide it by the total number of customers.

Average customer lifespan = (average number of years a customer stays active / number of customers)

Once you have the above components calculated, you can enter the values into the comprehensive customer lifetime value formula outlined below.

Customer lifetime value models

There are two models you can use to measure the value of your customers during the relationship. Deciding on one model over the other will lead to different outcomes.

Your chosen model depends on whether you want to predict the future using current and past customer behavior or use historical numbers to make an accurate prediction.

Predictive model

The predictive model forecasts future lifetime value by considering the buying behaviors of new and existing customers. These calculators use a combination of machine learning and regression.

The advantage of using the predictive model is identifying your most valuable customers. This figure can also show you which products and services are responsible for the most revenue, which can help you improve your customer retention strategy.

Historical model

The historical model is the simplest because it uses past data to predict customer value. It also doesn’t consider whether your existing customers will be customers in the future.

Businesses that only interact with their customers for a set period will find this model most useful. However, since the customer journey is different for everyone, the historical model does have its drawbacks.

Active customers could become inactive and cause inaccurate figures. It also works the other way, with inactive customers becoming active again.

How to increase customer lifetime value

Growing your business and optimizing your sales funnel for conversions and retention should be your two priorities.

Now that you have the customer lifetime value formula, you may be wondering which strategies can help you grow that number.

1. Interview your most valuable customers

The problem with the lifetime value calculation is it gives you nothing but a number. The first step to increasing your lifetime value is to understand what brought you to that number in the first place.

An excellent initial tactic is to get in touch with your most valuable customers and learn more about them. Ask probing questions like:

- How they use your product

- The most valuable aspect of your product

- What drew them to your brand

- How they’ve grown with your product line since they signed up

- The things they would change/improve

Using a variety of customer loyalty and satisfaction surveys such as NPS surveys or CSAT surveys and in combination with open-ended Additional Questions is the easiest way to gather this data from your customers.

Once you know what you’re doing well and where you can improve, you can launch a campaign of targeted change throughout your organization.

2. Raise your prices

One of the easiest ways to increase the value you get from each customer is to raise your prices. While this may be a touchy subject, you may find that you are undervaluing your products.

Ideally, most businesses should be raising their prices slightly every year. Moreover, they need to keep pace with their competitors.

Research the competition and see what they are charging. Are their price points broadly similar, or are they higher?

3. Invest in expansion revenue

Expansion revenue means selling more to your existing customers. There are several tactics you can employ to achieve more expansion revenue, including:

- Upselling – Get your customers to purchase an upgraded package. Higher-priced plans and products are an easy way of upping lifetime value.

- Cross-selling – The art of cross-selling is to focus on the products your customers use now and figure out what complementary products they may be attracted to.

- Add-ons – If you have several different packages, you may choose to offer add-ons to enhance their existing plans.

Obviously, which of the three tactics you use depends on your business model and what you sell. Regardless of your industry, you should be using at least one of the above to get more from your existing customers.

4. Start a rewards program

Customers want to know that they’re valued. If you treat your customers as numbers, they have no reason to stay loyal to your brand. Feeling unrecognized is one of the biggest reasons why customers look elsewhere.

Loyalty programs are an excellent way to reward and recognize the customer segment that sticks with you. Retail stores regularly do this through store cards.

Offering exclusive content or early access to your latest product or service are two other ways to reward your most loyal customers and reduce your churn rate.

5. Improve your customer experience

Studies have shown that companies that increase customer retention rates by 5% saw an uptick in profits between 25 and 95%. Customer retention and experience go hand-in-hand as retention is the result of positive customer experience. Improving customer experience not only has an immense effect on brand loyalty, but will ultimately increase customer lifetime value.

Wondering how you can improve your CX program? First and foremost, map out the customer journey to identify any pain points or areas of improvement to outline your strategy and goals. Make sure your support team is easy for customers to contact and that customer concerns are resolved by your team.

It’s also a good idea to collect feedback from different touchpoints in the customer journey, from transactions to customer service interactions. In fact, a majority of customers prefer to solve problems themselves as opposed to contacting support: adding articles or guides to answer common customer questions and issues can help cater to this demographic of customers. Check out our guide to self-service for more concrete tips.

With just a few overarching goals for your CX program, you’ll improve the customer experience at your business in record time.

Gain valuable insights from your customers

The lifetime value of your customers all goes back to the sort of experience you provide. A great product or service isn’t enough to extract the most value from your customers.

Breeding loyalty and encouraging customers to upgrade from their existing packages is experience management 101.

With Delighted, you can quickly gain valuable insights from your audience, figure out where you need to make changes, and improve customer experience metrics to help your business succeed. Plug yourself into the minds of your customers with our survey templates.