When you talk about measuring customer experience and satisfaction, three metrics inevitably come up as THE ones to use: Customer Satisfaction Score (CSAT) vs Net Promoter Score (NPS) vs Customer Effort Score (CES).

So, which is best for you?

While NPS, CSAT, and CES all garner feedback about how a customer feels about your company, products, and services, there are nuances that make one better than the other depending on your use case and business goals.

In this article, we’ll explore their differences and help you understand how to use each for measuring your customer experience.

CSAT vs NPS vs CES: What does each measure?

When you start your customer experience program, the first step is to figure out what you’re trying to accomplish through the data gathered in your customer experience study. Let’s take a look at two types of studies and why you would want to use them.

Relationship studies: Long term customer sentiment

You want to evaluate the quality of the overall relationship a customer has with you. The goal is to monitor how your customer base feels about your company over time as both your business and the market evolve. Insights gathered are to inform strategies that improve customer loyalty, and subsequently revenue through increased customer retention, reduced churn, and word of mouth.

Transactional studies: Short term customer satisfaction for product or service

You want to measure how well your company helps customers complete certain tasks, whether that’s with your product or your support team. The goal is to gain specific, actionable feedback to improve certain products, processes, and services.

It’s important to note, you can use a mix of both relational and transactional surveys to capture feedback throughout the customer lifecycle in a customer journey map.

Where do NPS, CSAT, and CES fall into these categories?

- NPS is primarily a relationship study metric (though it can also be leveraged for transactional studies — more on this later).

- CSAT can be either a relationship or transactional study metric.

- CES is purely a transactional metric.

When you take a closer look at the single-question survey used to calculate each metric, you’ll see what makes these studies relational vs transactional.

Net Promoter Score (NPS) surveys: A relational measurement

Since Bain & Company noted NPS as an indicator of future business growth due to correlation to customer loyalty, NPS has been widely adopted internationally by some of the world’s largest brands.

If you use an NPS tool, you’ll be able to benchmark against yourself and competitors using the standard relationship NPS study, which is helpful for winning buy-in from key company stakeholders. (You can learn more about what a good NPS score is here.)

In addition, the NPS survey scoring method segments your customers into 3 groups: promoters (ratings of 9 or 10), passives (ratings of 7 or 8), and detractors (ratings of 6 or lower), so you can tailor campaigns and solutions to win and maintain the loyalty of each.

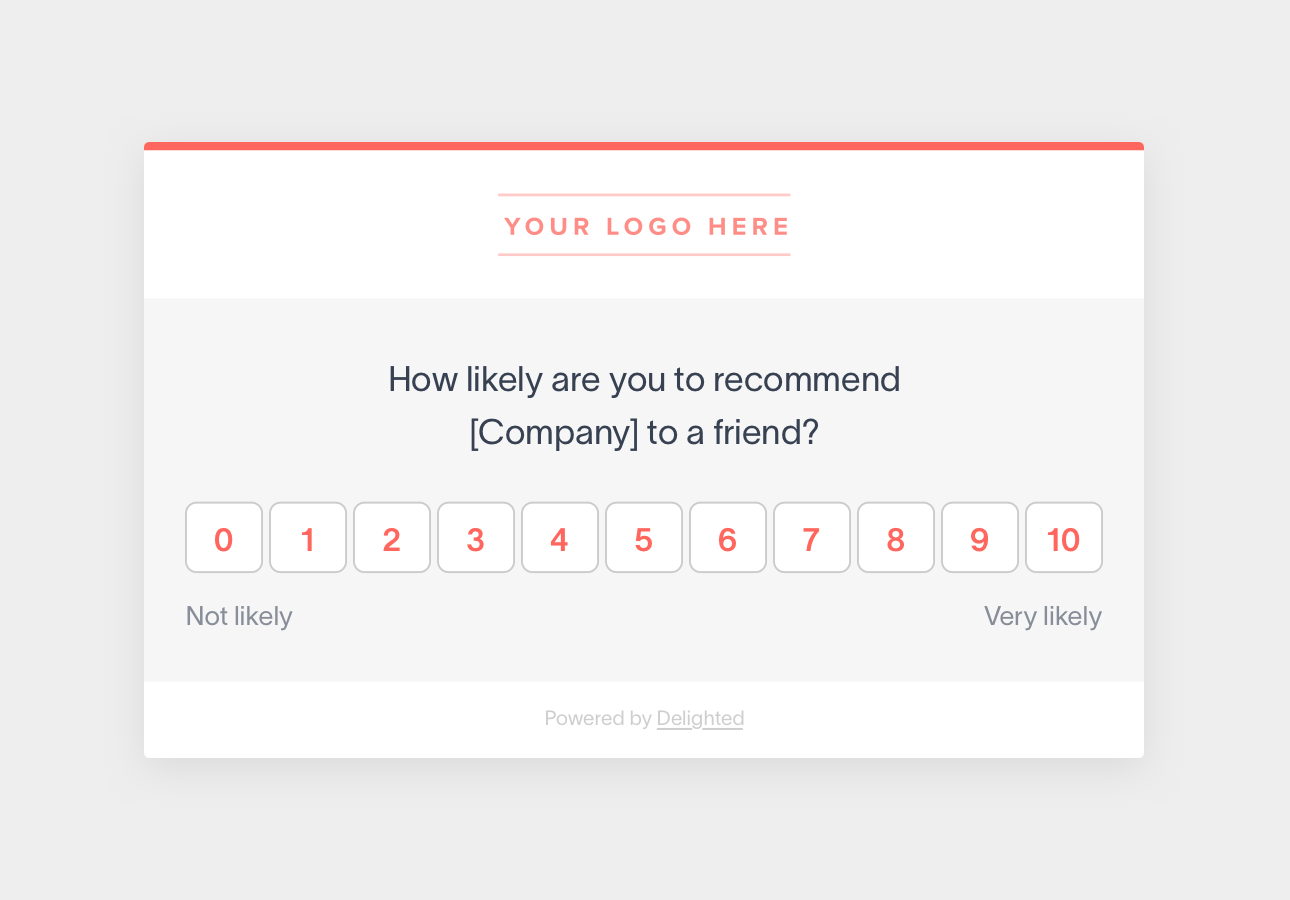

NPS asks a simple question:

On a scale from 0 to 10, how likely are you to recommend [company] to a [friend or colleague]?

What makes this a relationship survey is the fact that:

- The question isn’t specific to any particular event or transaction.

- The question is scoped to the brand overall, which means that if you survey your customers on a regular basis, you’ll be able to monitor customer sentiment toward your brand over time.

To make the NPS survey question transactional, you need to modify it a bit more: On a scale from 0 to 10, how likely are you to recommend [company] to a [friend or colleague] based on [your most recent interaction]?

When to send NPS surveys

For new customers, send out your initial survey after they’ve had time to fully experience your product or service. From then on, send your survey out on a regular cadence (quarterly or biannually) to monitor evolving customer sentiment.

For more in-depth guidelines by industry, check out our post on when to send your NPS survey.

NPS score calculation

Your NPS is expressed on a scale of -100 to 100. Calculate NPS by subtracting the percentage of promoters (people who rate you 9 or 10) from the percentage of detractors (people who rate you 6 or lower).

Customer Satisfaction (CSAT) surveys: A relational and transactional measurement

Simple to adopt for both relationship and transactional studies, CSAT surveys are intuitive for everyone in the company to understand, and is available on Delighted’s customer satisfaction software.

Because the question format is so versatile, it is extremely effective for tracking how your customer feels through the entire customer lifecycle. If satisfaction drops at any touchpoint, you will have the insights necessary to follow up with the customer and close the feedback loop.

CSAT surveys also give you the option to swap out the numeric rating scale for visual rating scales, like stars or smileys, which might be more on-brand for an engaging survey experience.

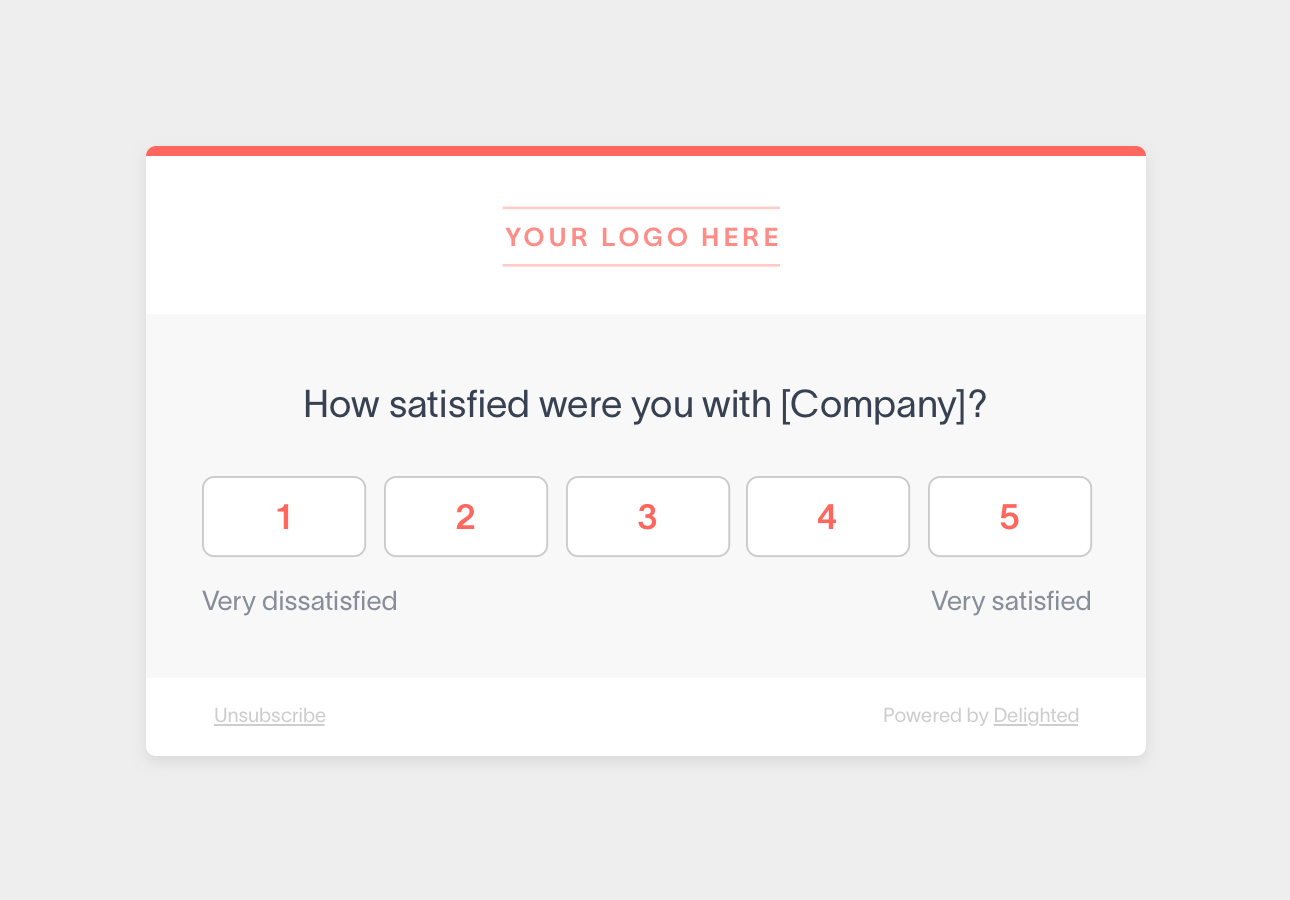

CSAT asks the question:

On a scale from 1 to 5, how satisfied were you with [company/interaction]?

By swapping out what you ask your customer to rate (your company or a specific interaction) or adjusting the timing of your survey (i.e. surveys triggered twice a year as opposed to surveys triggered post-transaction) you can use your CSAT survey for either a relationship or transactional study.

When to send CSAT surveys

Transactional CSAT surveys should be timed for recency, depending on what you’re evaluating. For sales, onboarding, or support interactions, ask for CSAT feedback immediately. For product feedback, time the survey so that you’ve given the customer enough time to fully experience your product.

Relationship CSAT surveys would be sent regularly over longer periods of time, similar to NPS surveys.

CSAT score calculation

Your CSAT score is the percentage of respondents who are “4 – satisfied” and “5 – very satisfied.”

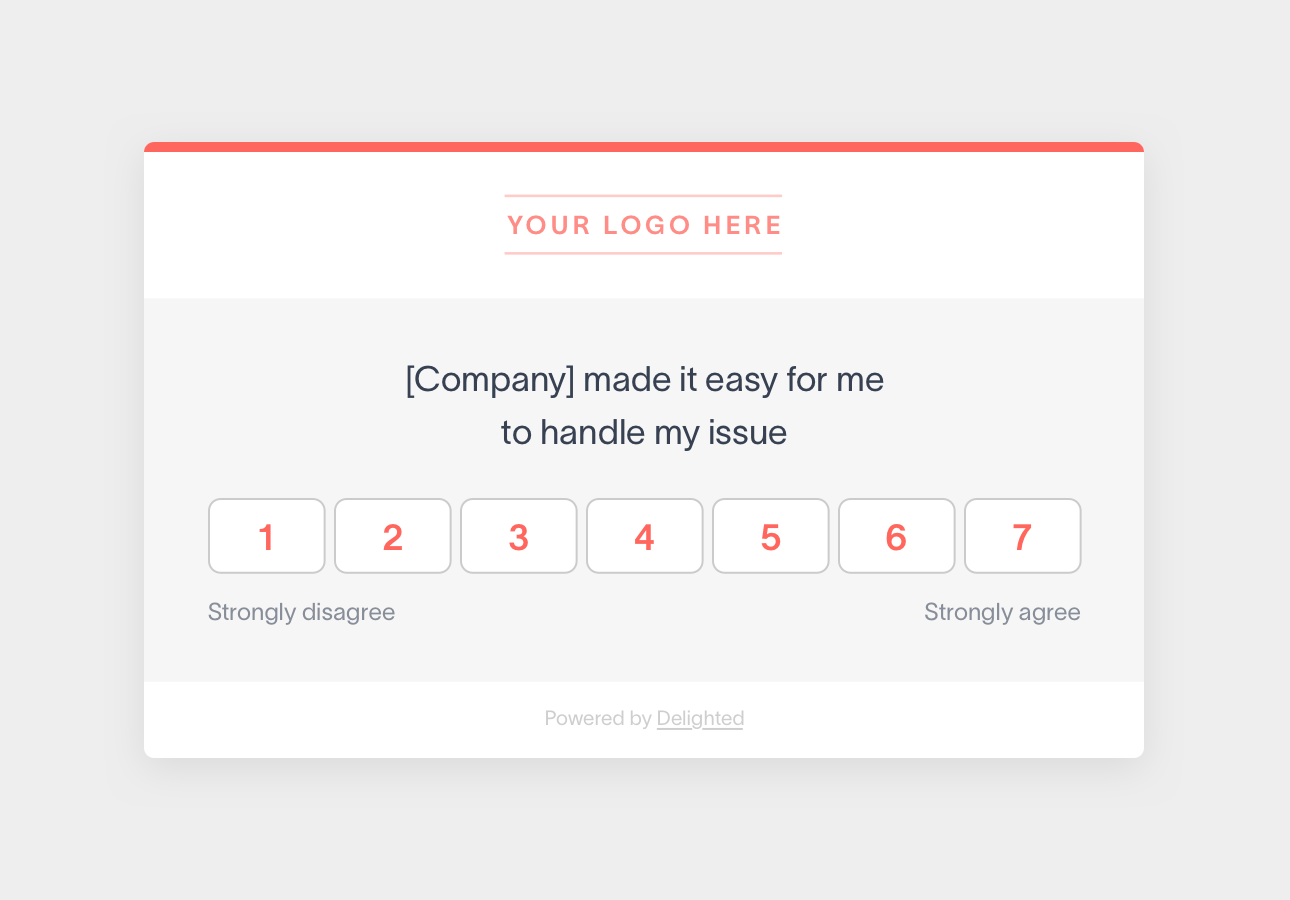

Customer Effort Score (CES) surveys: A transactional measurement

CES explores how much effort a customer feels they had to put in to resolve an issue, and is usually used to help customer service improve resolution times and provide higher-quality experiences.

In the case of CES surveys, the hyper-focused effort score question is great for getting actionable feedback for certain use cases, oftentimes sent after customer service interactions.

CES asks the question:

On a scale of 1 to 5, rate how easy [company/person] made it for you to [accomplish a task].

Customer effort score surveys emphasize a specific task or interaction in the question, which makes it perfect for transactional studies. CES has also been correlated to customer loyalty.

When to send CES surveys

Similar to CSAT, you should ask customers to evaluate an interaction immediately after it happens. This could be just after a purchase, or after the resolution of a service ticket.

Take a look at a robust customer service survey solution for more insight into where and when to input your CES survey.

CES score calculation

Your CES score is the percentage of respondents who “4 – agree” and “5 – strongly agree.”

Since NPS and CSAT can both be used for the relationship and transactional use case, let’s compare them first.

CSAT vs NPS: What’s the difference?

The difference between these two customer experience metrics is that NPS is a long-term metric that measures how likely a customer is to recommend your product or service to others, whereas CSAT can be a short-term or long-term metric that measures customer satisfaction with a specific interaction, purchase, or feature.

This difference is made clear with the built-in connotation of the words “satisfaction” and “recommendation.” Satisfaction tends to be a more short-lived sentiment, while recommendation tends to be harder won.

In short, just because someone is satisfied, doesn’t mean they’d recommend you to a friend.

Why might you choose CSAT vs NPS, or vice versa?

Choosing CSAT vs NPS boils down to whether you’re evaluating customer happiness with your products and services in the short term, or if you’re trying to measure long-term brand loyalty.

Oftentimes, brands will use both: NPS to keep an eye on the overall quality of the experience, and CSAT for more targeted service and product feedback.

Now that we’ve taken a look at CSAT vs NPS, let’s take a closer look at CES, NPS, and customer loyalty.

NPS vs CES: Measuring overall customer loyalty

Customer Effort Score made headlines when a Gartner study found that “Effort is the stronger driver of customer loyalty,” which put it in contention with NPS. However, CES still hasn’t taken off the way NPS has, making it difficult to use as a competitive benchmark.

CES is a meaningful metric mainly due to how badly one negative customer service experience can taint the overall brand interaction. For example, “94% of customers with low-effort interactions intend to repurchase compared with 4% of those experiencing high effort.”

Because of that, studies have found that the CES scores tend to correlate with the NPS score when it comes to measuring customer loyalty.

Still, does that mean you should only use one metric or the other?

Why might you choose NPS vs CES, or vice versa?

If you’re focusing on improving customer service metrics, CES surveys are a great way to help reduce time to resolution and customer friction. However, if you need a broader evaluation of your overall customer experience and an easy way to segment your customer base according to sentiment, NPS is the way to go. Or, you can always use both.

Since not every experience, industry, or business is the same, experimentation can always help you narrow down what metrics make the most sense for you.

In review: CSAT vs NPS vs CES? What’s your customer experience goal?

As you’ve gathered, you should start by asking yourself the question: What’s the goal of my customer experience strategy?

- If you are going through an overhaul of your products and services, asking customers for CSAT feedback every step of the way can help you decide in real-time whether the changes are a good idea.

- If you are looking to understand customer loyalty and how your brand is perceived overall, use NPS.

- If you want to isolate and improve areas of customer friction, CES is the ticket.

Of course, using a combination of these methods will give you the most comprehensive overview of customer sentiment. Sometimes, you may also need to experiment with multiple metrics to see which result in the most insightful, actionable feedback for your business.

No matter which metric you choose to track, as long as you use your customer feedback insights to close the loop and influence change, you will be well on your way to delighting your customers.

Take a look at some helpful tools for taking action on customer feedback and in turn, improving customer experience in the long run.

Ready to start measuring customer satisfaction? You can use Delighted’s customer experience solution to send all of the survey types we’ve discussed: NPS, CSAT, CES, Smileys, 5-Star, and even Thumbs.