What You Need to Know About Contact Center AI

InMoment XI

JANUARY 16, 2024

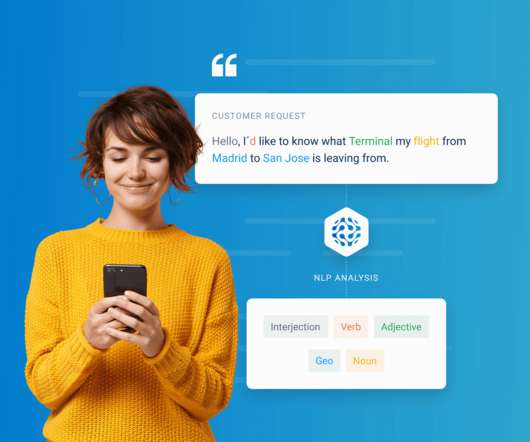

Virtual Agents and Chatbots: Virtual agents or chatbots, powered by AI, interact with customers in real-time. These agents can engage in text-based or voice-based conversations that provide assistance, answer queries, and guide users through processes.

Let's personalize your content