Loyalty programs: should you issue your own points or miles?

Currency Alliance

APRIL 15, 2024

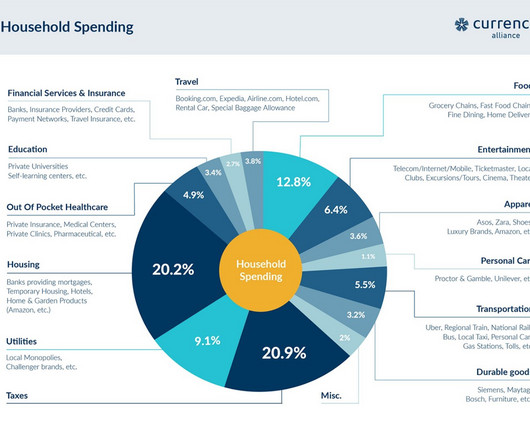

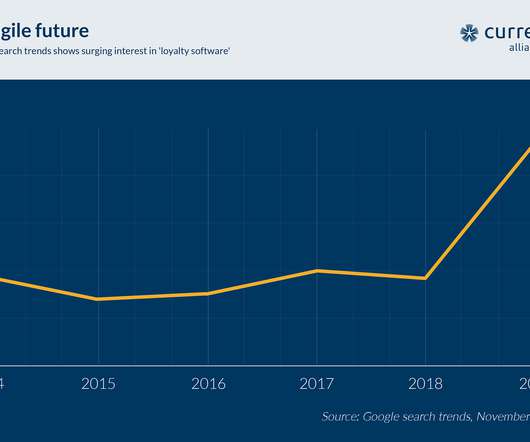

Many people assume that operating a loyalty program necessarily implies issuing your own loyalty points or miles. The optimal points to offer mostly depends on the frequency of engagement your brand has with target customers. Points and miles are a dominant and popular form of loyalty value.

Let's personalize your content