Creating Fans, Not Just Customers: Metro Bank’s Journey to Customer-Centricity

InMoment XI

MARCH 20, 2024

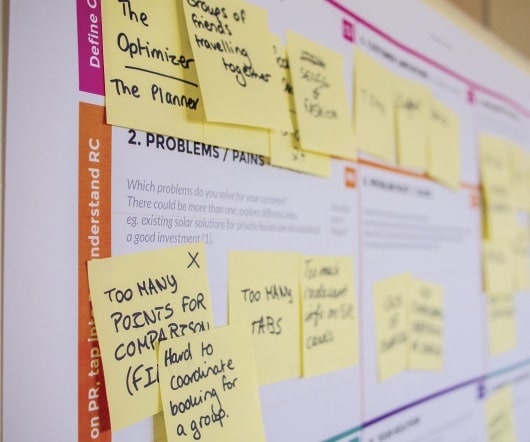

In the midst of a financial industry crisis, Metro Bank emerged in 2010 with a bold vision—to create fans, not just customers. The collaborative effort aimed to redefine their insight strategy by incorporating competitive benchmarking, relationship surveys, and touchpoint surveys to understand customer “moments of truth.”

Let's personalize your content