Banks should leverage customer segmentation and data to meet top customers and protect deposits

West Monroe

MARCH 28, 2023

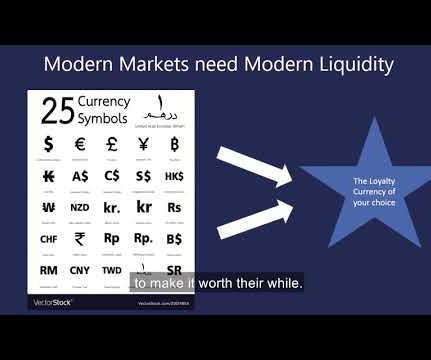

What’s more, recent market volatility and threats to banks around deposit run off only heighten the need for banks to adopt a balanced segmentation and portfolio management strategy—one anchored by data—that can help banks both attract and deepen relationships with their most valuable customers and mitigate risk of deposit runoff.

Let's personalize your content