The Future of Customer Experience in Banking in 2023

Lumoa

SEPTEMBER 30, 2022

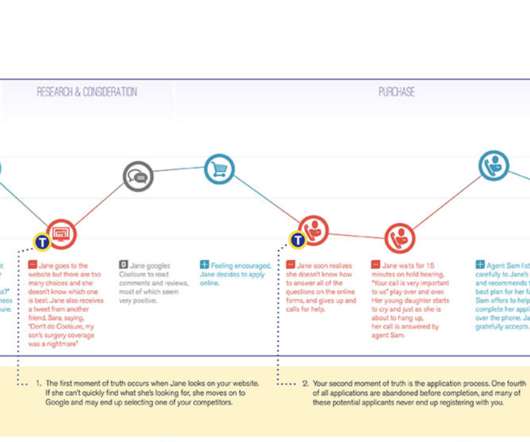

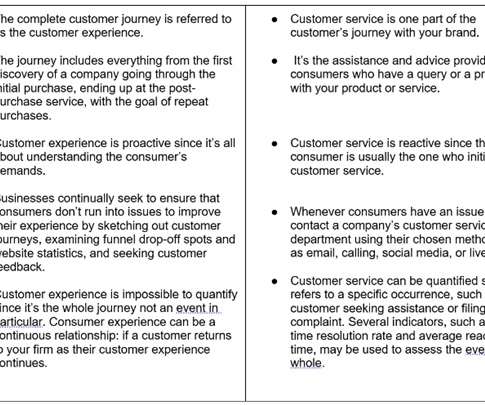

By now, the importance of delivering a superb customer experience in banking is crystal clear. It’s estimated that financial brands that deliver a better customer experience (CX) receive twice as many recommendations. Let’s take a look at the trends that will shape the customer journey in banking in 2023 and beyond.

Let's personalize your content