Financial Services Reputation Management: Secure Lifelong Customers

InMoment XI

APRIL 25, 2024

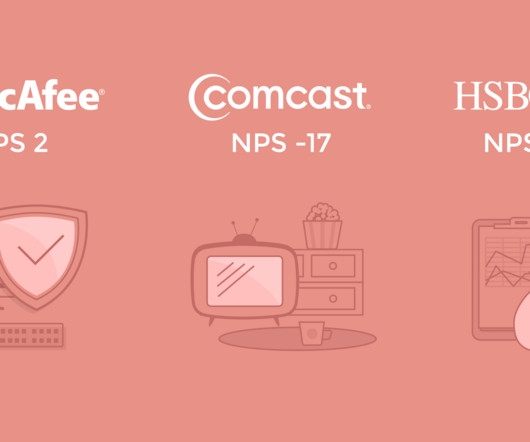

Did you know that over half of financial services consumers say they have low trust in their provider? And, of those consumers, only 34% of them would recommend their brand to friends and family. Since finances are such a personal part of our lives, consumers in the industry are the most withholding of their trust.

Let's personalize your content